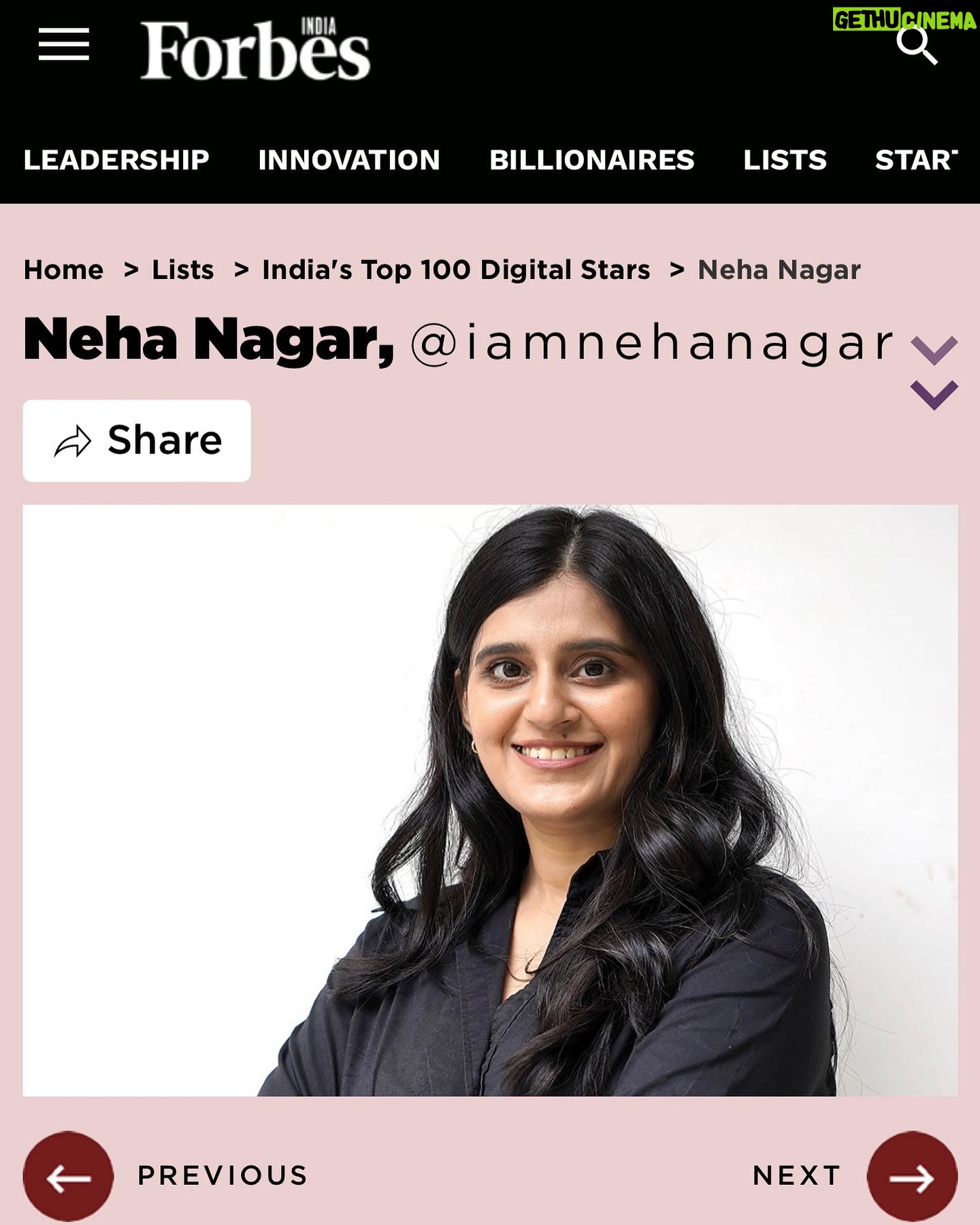

Neha Nagar Instagram – Important information👇

It is important to know that even though the tax percentage has been reduced, government has removed the indexation benefit on your investments. Before calculating actual profits it is important to consider removal of the indexation benefit.

Good News in Budget 2024’ series.

Part 2:

Gold prices in India are finally dropping, making this potentially the best time to invest in the precious metal.

Here’s why:

1️⃣ Custom duty slashed: The government has reduced custom duty on gold imports from 15% to 6%. As India imports most of its gold, this will significantly lower raw gold prices, leading to cheaper gold for consumers. We’re already seeing the effects, with gold prices dropping from ₹76,000 to ₹71,000 per 10 grams!

2️⃣ LTCG tax reduced: Long-Term Capital Gains (LTCG) tax on gold has been cut from 20% to 12.5%. This means you can save 7.5% on taxes when selling your gold for profit after the long-term holding period.

3️⃣ Shorter LTCG period: The holding period for LTCG has been reduced from 3 years to 2 years. Now, if you sell your gold after 2 years, you’ll only pay the lower LTCG rate of 12.5% instead of the higher Short-Term Capital Gains (STCG) tax.

Future outlook: With countries worldwide increasing their gold reserves, prices are expected to rise in the future. This could be the perfect opportunity to invest!

Share your thoughts below! 👇

[ Budget2024 GoldInvestment IndianEconomy FinancialPlanning GoldPrices TaxBenefits InvestmentOpportunities ] | Posted on 25/Jul/2024 21:47:56