Most liked photo of Neha Nagar with over 1.5 Million likes is the following photo

We have around 101 most liked photos of Neha Nagar with the thumbnails listed below. Click on any of them to view the full image along with its caption, like count, and a button to download the photo.

1.5 Million Likes – Neha Nagar Instagram

Caption : Ram Ram Bhai Sariyanne Met @ankit_baiyanpuria at the NDTV event. #Nehanagar #ankitbaiyanpuriyaLikes : 1454952

470.9K Likes – Neha Nagar Instagram

Caption : My daughter Siya will have 1 Cr rs at the age of 18. In India education inflation is around 12%, which means school and college fees are doubling every 6 years.That’s why it has become a necessity to Save & Invest money for a child’s future . So, I opened a 3-in-1 child account in Siya’s name, which has facilities for a bank account, demat account and trading account. Then we decided that my husband and I will separately save 6500 rupees every month for Siya. (Neha-6500 Deepak-6500 = Total 13000) And we will invest this amount in India’s index NIFTY50 through Nifty ETF. Some popular NIFTY 50 ETFs – 1. NIFTY BeES 2. Nifty 50 ETF 3. NIFTY ETF So by investing 1.56 lakhs every year, we will invest a total of 28 lakhs in 18 years. And if we take the historical average returns of 12% for NIFTY50, then Siya will have 1 crore rupees at the age of 18. Also, we will keep increasing the investment amount every year by 10 % ,and by that SIYA will get more that 1 CR at the age of 18. This will allow Siya to handle expenses such as higher education, travel and marriage herself. But what if Siya does not use this 1 crore rupees properly ? To find out the answer to this question, follow @iamnehanagar for the next part.Likes : 470923

445.4K Likes – Neha Nagar Instagram

Caption : Paytm will shut down ?Uninstall the app ? RBI has a come up with a new rule. From March 1st, some customers will not be able to do some transactions through Paytm. As Restrictions are on Paytm Payment Bank transactions, not on Paytm transactions . People with accounts in Paytm Payment Bank won’t be able to use money deposit, UPI, Fastag, Wallet etc. from March 1st. But normal Paytm users who link their bank accounts and use Paytm with UPI or wallets won’t be affected. And even those with Paytm Payment Bank accounts don’t need to worry. They can still withdraw their money after 1 March . Spread the right info. Neha Nagar, Paytm Crash , Paytm News , Personal Finance , Stock MarketLikes : 445390

![Neha Nagar - 407K Likes - Myth: Changing your surname after marriage is necessary.

Fact: There is no legal requirement to change your surname after marriage. It is a personal choice.

Why I didn’t change my surname:

-I don’t want to go through the hassle of changing my name on all my documents.

-I want to keep my maiden name as a part of my identity.

-I don’t believe that changing my surname will make me any more or less married.

What about inheritance?

There is a common myth that you can only inherit property from your spouse if you share their surname. This is not true. You can inherit property from anyone, regardless of your surname.

What about my children?

There is no need to worry about your children having different surnames from you or your spouse. Children can have either parent’s surname, or a hyphenated surname.

The decision of whether or not to change your surname after marriage is a personal one. There is no right or wrong answer. Do what feels right for you.

Follow me for more insights.

[surname marriage finance inheritance nehanagar ]](https://www.gethucinema.com/wp-content/uploads/2025/01/Neha-Nagar-0-GCNxZM6226.jpg)

407K Likes – Neha Nagar Instagram

Caption : Myth: Changing your surname after marriage is necessary. Fact: There is no legal requirement to change your surname after marriage. It is a personal choice. Why I didn’t change my surname: -I don’t want to go through the hassle of changing my name on all my documents. -I want to keep my maiden name as a part of my identity. -I don’t believe that changing my surname will make me any more or less married. What about inheritance? There is a common myth that you can only inherit property from your spouse if you share their surname. This is not true. You can inherit property from anyone, regardless of your surname. What about my children? There is no need to worry about your children having different surnames from you or your spouse. Children can have either parent’s surname, or a hyphenated surname. The decision of whether or not to change your surname after marriage is a personal one. There is no right or wrong answer. Do what feels right for you. Follow me for more insights. [surname marriage finance inheritance nehanagar ]Likes : 407037

264.5K Likes – Neha Nagar Instagram

Caption : Should Indian people become FSSAI? Some products from Indian species like MDH and Everest are being banned in Hong Kong and Singapore over the alleged presence of a cancer-causing compound called “ethylene oxide.”. But ideally, this quality checking and food standard maintenance work has to be done by “FSSAI,” which is a government body for this only. So, what can we Indians do? 1. Check the ingredient label of every food item that you purchase from stores, online,online etc. The majority of food items contain excessive sugar, and many contain harmful chemicals used for food preservation. 2. Be aware of misleading advertisements, as many brands try to showcase their products as healthy. e.g., Bourvita, Cerelac,cerelac ,Patanjali etc. Don’t fall for their misleading ads as prey. Complaint for misleading ads here: https://gama.gov.in/Default.aspx 3. In today’s time, checking food labels is not enough because there are fake species out there on the market, so we may have to test whether our species are real or fake. Cinnamon: Check the label before purchasing the cinnamon; if it says cassia, then it’s fake. Check the texture to see if it is lighter, softer in texture, and much thinner in circumference than the real cinnamon. Real cinnamon has a strong aroma, while cassia doesn’t have that. Star Anise: Star Anise has a subtle flavour to it and has a woody appearance. While buying the spice, one should always notice the eight segments and shiny seed; if it is dark, then it is of bad quality. Chilli: Many sellers add colour to make chilli appear fresh. It can also contain brick powder, talk, or soapstone. To check whether it is authentic or not, you can put the powder in a glass of water, and if it does not dissolve or change colour, then it is a genuine spice. Turmeric: This spice is made from a root resembling ginger, but it has a deeper yellow colour. To check, you can dissolve a pinch of turmeric in a glass of water; if the powder comes up, it is not genuine. It is said that adulterated turmeric contains lead and starch. Lastly, never buy loose species (Khula Masala), as it is banned in India. On the contrary, we should use “sabut/khada masala” at home.Likes : 264527

243.8K Likes – Neha Nagar Instagram

Caption : Retail inflation is 6 % Medical inflation is 10 % Education Inflation is 12 % So, you need to start planning for your child as early as possible. You can start researching about these 3 Government schemes ( Risk Free ) 1. Sukanya Samriddhi Yojana : Govt pays 8% p.a. currently with EEE Tax benefits & you can Invest 1k to 1.5 L yearly. ( only for girls ) 2. Post Office Term Deposit : Current Interest rate 7.5% with Tax benefits u/s 80C Invest minimum 100 Rs per month. ( For everyone ) 3. National Savings Certificate : Invest minimum Rs 1000 yearly, current interest rates are 7.7% & with Tax benefits u/s 80C ( For everyone) You can connect with your Bank manager or visit post office for these schemes. Start planning for her future through government’s risk free schemes. #nehanagar #personalfinanceLikes : 243846

227.6K Likes – Neha Nagar Instagram

Caption : Earn up to 7%* p.a. interest on your savings account! With Kotak 811’s Activmoney feature, you can earn FD-like interest on your savings account, but with the flexibility to withdraw your money at any time. No more worrying about breaking your fixed deposit and incurring a penalty. With Activmoney, you can access your money whenever you need it, without any hassle. So what are you waiting for? Open a savings account powered by ActivMoney now! Check the link in bio https://bit.ly/3ZJ0nTe #kotak811 #ActivMoney #finance #investmentLikes : 227590

192.7K Likes – Neha Nagar Instagram

Caption : How to check if you are ready for a baby or not? Here’s a simple rule- It’s called the 1-100-10 Rule 1.You should be able to cover 100% of the costs of having the baby, including before and after pregnancy expenses. 2.You need to have enough money saved up to cover childcare costs for at least 1 year in advance. 3.You can spend around 10% of your total income on raising the child. For example, if you and your partner have enough savings for the first year of child expenses, and your combined income is 20 lakh rupees, it means you can spend up to 2 lakh rupees each year on raising your child. If you can manage to do that, then it might be a good time to have a baby. Follow @iamnehanagar for more interesting reels.Likes : 192713

185.5K Likes – Neha Nagar Instagram

Caption : Burn all your insurance policies ? In India, there are ₹25,000 crores worth of unclaimed life insurance policies. Because over time, people lose their insurance papers, which prevents their family members from claiming that money. From April 1st, the government has made it mandatory to have a demat account for new insurance policies. It’s called an e-insurance account! Means, if you purchase any health, life, motor, or any other insurance after April 1st, that policy will be stored online in your e-insurance account, not in paper format. You should store all your existing policies in e-insurance account. Just go to the CDSL, NSDL or CAMS website and open your e-insurance account for free and store all your insurance policies in dematerialized form. Remember to share the login ID of this account and this video with your family members, don’t forget.Likes : 185468

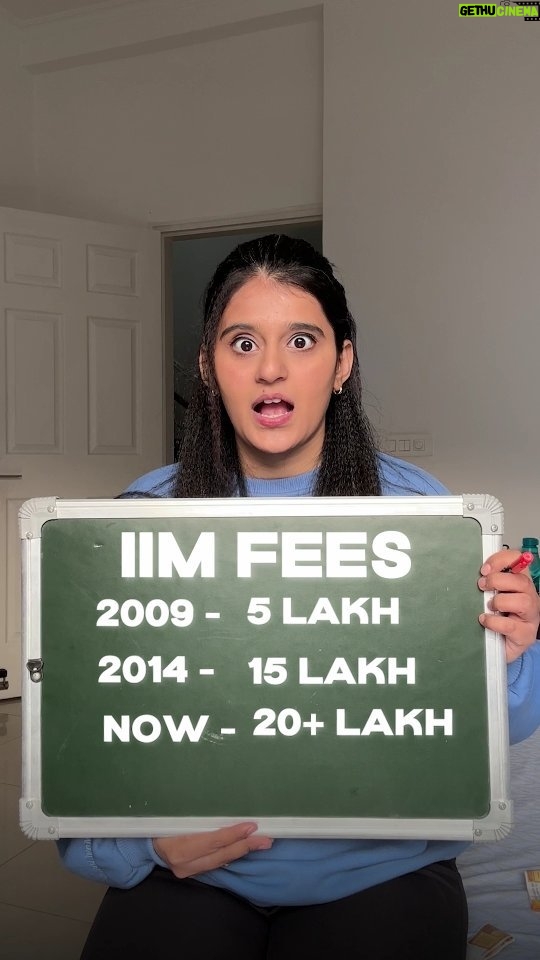

183.1K Likes – Neha Nagar Instagram

Caption : 3 investments for Boy child : In India education inflation is around 12%, which means school and college fees are doubling every 6 years. IIM Fees: 2009 – 5 lakh 2015 – 14 lakh Now – 20 lakh 1. Sovereign Gold Bonds (SGBs): * Safest option with an approximate 10% return. * 5-year lock-in period, but tax-free returns if held until maturity (8 years). * Additional 2.5% yearly interest from the government on top of market gold returns. 2. Nifty 50 Index Funds: * Higher risk, but historical average returns of 12% can significantly boost your portfolio. * Nifty 50 grew 20 times since inception in 1995, reaching a record high of 20,000 in 2023. * Tax benefits: Invest in ELSS for potential tax deductions. 3. National Savings Certificate (NSC): * Zero-risk investment * Tax-saving benefits with a 5-year tenure. * Offers a guaranteed 7.7% return. Research more about these and invest wisely. Let me know your questions in the comments. ( Neha Nagar, Investment , Finance )Likes : 183104

![Neha Nagar - 176.5K Likes - Earn More Than FD with This Govt. Scheme!

The Mahila Samman Savings Certificate (MSSC) is a government-backed savings scheme designed exclusively for women, offering 7.5% annual interest, which is higher than most fixed deposits (FDs). This is a safe and short-term option to grow your savings.

Key Features:

✅ High Returns: 7.5% annual interest, compounded quarterly

✅ Flexible Investment: Start with as little as ₹1,000, up to ₹2 lakh

✅ Short Tenure: Maturity in just 2 years

✅ Partial Withdrawal: Withdraw 40% anytime in case of medical or financial emergency

✅ No Market Risk: Guaranteed returns with zero risk

Where to Open?

You can open this savings scheme at any authorized bank or post office.

This scheme is available only till 31st March 2025.

A great opportunity for women to secure their savings with high returns. Share this information with those who can benefit.

[MahilaSamman NehaNagar FD SmartSavings FinancialFreedom WomenEmpowerment ]](https://www.gethucinema.com/wp-content/uploads/2025/02/Neha-Nagar-10-okdcvZ9744.jpg)

176.5K Likes – Neha Nagar Instagram

Caption : Earn More Than FD with This Govt. Scheme! The Mahila Samman Savings Certificate (MSSC) is a government-backed savings scheme designed exclusively for women, offering 7.5% annual interest, which is higher than most fixed deposits (FDs). This is a safe and short-term option to grow your savings. Key Features: ✅ High Returns: 7.5% annual interest, compounded quarterly ✅ Flexible Investment: Start with as little as ₹1,000, up to ₹2 lakh ✅ Short Tenure: Maturity in just 2 years ✅ Partial Withdrawal: Withdraw 40% anytime in case of medical or financial emergency ✅ No Market Risk: Guaranteed returns with zero risk Where to Open? You can open this savings scheme at any authorized bank or post office. This scheme is available only till 31st March 2025. A great opportunity for women to secure their savings with high returns. Share this information with those who can benefit. [MahilaSamman NehaNagar FD SmartSavings FinancialFreedom WomenEmpowerment ]Likes : 176487

167.8K Likes – Neha Nagar Instagram

Caption : Do this before your marriage ! In India, the average cost of a wedding is around ₹20 lakh. This month, there are an estimated 35 lakh weddings taking place, which will total ₹4 lakh crore. But what if your wedding is cancelled or postponed due to an uncertain event, such as a wedding cancellation, property damage, or personal accidents. In this case, wedding insurance can provide financial protection for your wedding expenses. It typically covers liability, cancellation, damage to property, and personal accidents. Also, it covers the following expenses when a wedding gets cancelled: # Advances paid to cater # Advances paid for venue rental # Advances paid to transportation # Advances are given for hotel room booking etc The cost of wedding insurance varies depending on the amount of coverage you choose. A ₹20 lakh cover policy typically costs around ₹2000; this premium is subject to change in accordance with the location . Because a ₹20-lakh cover for a wedding in Mumbai or Delhi will cost between Rs 10,000-20,000 . It is important to purchase wedding insurance at least 3 years before your wedding date. This is because most policies have a waiting period of at least 90 days. Not many insurers offer wedding insurance in India. Among those who do are Future Generali, ICICI Lombard, Bajaj Allianz, Oriental Insurance, and the National Insurance Company. Follow for more such informative content !Likes : 167759

165K Likes – Neha Nagar Instagram

Caption : Beware of the Jumped Deposit Scam! A new type of UPI fraud is on the rise where scammers use a clever trick to steal money from your bank account. Here’s how it works: 1️⃣ Scammers send a small amount (₹1000-₹5000) to your account. 2️⃣ You open your UPI app to check your You open your UPI app to check your balance. 3️⃣ While you’re checking, they send a fake payment request, making it look like part of the balance check process. 4️⃣ If you mistakenly enter your UPI PIN, your account can be drained! 💡 How to Protect Yourself: Always verify unexpected payments—don’t assume they’re accidental or harmless. If you receive a payment request while checking your balance, enter an incorrect PIN first. If it’s fake, it will cancel the transaction. Share this information with your loved ones to keep them safe from this growing scam Stay informed and protect your money. Awareness is the key! 🔒 #UPIscam #FraudAlert #OnlineSafety #CyberCrime #JumpedDepositScam #UPIFraud #StaySafe #FinancialSecurity #ScamAwareness #DigitalSafetyLikes : 164958

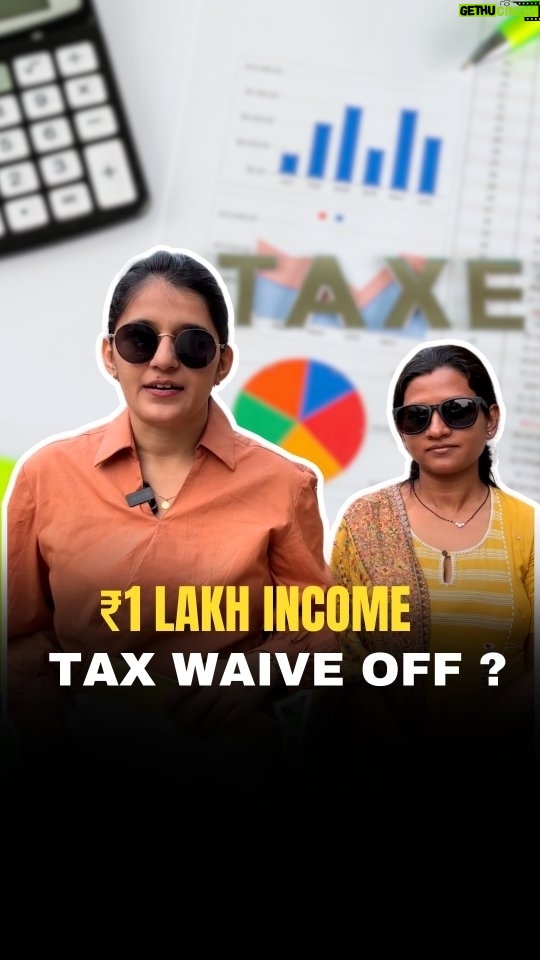

159.4K Likes – Neha Nagar Instagram

Caption : Government is waving off your taxes ? The Finance Minister announced in the 2024 budget that all tax demand notices from 1962 to 2010 will be waived off if the value of the notice is less than Rs 25,000. And tax notices from 2010-2015 will also be waived off if the value is less than Rs 10,000. Also, if there are multiple notices, then tax notices up to Rs 1 lakh will be waived off. To avail the waiver, you will need to file an application with the Income Tax Department. The application form can be downloaded from the website of the Income Tax Department. The last date for filing the application is March 31, 2024. Here are the steps to apply for the waiver: 1. Download the application form from the website of the Income Tax Department. 2. Fill in the application form and attach the required documents. 3. Submit the application form to the Income Tax Department. The required documents are: -Proof of identity, Proof of address, Proof of income, Tax demand notice The Income Tax Department will process your application and will inform you about the decision within 30 days. Follow @iamnehanagar for more such insights.Likes : 159386

155.1K Likes – Neha Nagar Instagram

Caption : Is 10-minute grocery delivery worth it? -Pricey & Limited: This fast delivery often means pricier groceries with higher markups (like 10–30% more!). -Surge Charges: Pay more in cases of high demand. (Rs. 30 to Rs. 100) -Freshness Fear: Rushing the delivery might not be the best for fresh fruits and veggies. -Safety Matters: We shouldn’t risk the delivery person’s safety for super speed. -Impulse buys: Feeling like you need things right now can lead to grabbing things you don’t really need. So what should we do? Taking a little more time for delivery lets you plan your list better and avoid impulse buys. My secret weapon for this is “Flipkart Grocery.” -Next Day Delivery: Get your groceries the next day, without the crazy rush. -Save Money: Huge savings of 30% (Rs. 300 for every Rs. 1000) Check out the “Flipkart Grocery” in your Flipkart app.Likes : 155070

149.9K Likes – Neha Nagar Instagram

Caption : Koi ITC ko tag nai krega..Likes : 149851

146.8K Likes – Neha Nagar Instagram

Caption : Struggling to save with rising grocery costs? With Flipkart Grocery, you get 2000 items at 10-15% cheaper prices than regular stores. I compared my monthly grocery bill with Flipkart’s prices and saved ₹2500! 🎉 Now I can invest the extra money in an FD. Join the Check Your Own Bill Challenge: Share your grocery bill with Flipkart, and if their prices are lower, the savings are yours! Shop smart, save more, and reach your goals faster.Likes : 146773

144.2K Likes – Neha Nagar Instagram

Caption : SEBI has a new rule for stockbrokers! Have you ever checked your demat account statement and found that money has been deducted without your permission? This is a common problem caused by technical glitches. In the past, stock brokers would often use this as an excuse to avoid taking responsibility for the losses. They would claim that there was a clause in the demat account opening form that absolved them of liability for technical glitches. This is no longer the case. SEBI will now introduce a new rule that requires stock brokers to explain the most important terms and conditions to their clients in plain English. This is a big win for investors, as it means they’ll be better informed about their investments and less likely to be taken advantage of by stock brokers. The new rule goes into effect on April 1, 2024, for new clients and on June 1, 2024, for existing clients. 3 Hacks to Avoid Losing Money from Technical Glitches in the Demat Account: 1.Set up alerts and notifications: Enable alerts for order confirmations, price movements, and margin utilisation. Get notified of any suspicious activity or potential glitches in your account. 2.Regularly review your Demat account statements: Review your statements regularly to identify discrepancies or unauthorised transactions. Detect technical glitches early on and take corrective action. 3.Maintain a minimum cash balance in your demat account and only deposit funds when you intend to purchase stocks. Share this reel with your friend for more awareness.Likes : 144245

139.8K Likes – Neha Nagar Instagram

Caption : You are a ⭐️ @iamnehanagar ❤️Likes : 139826

137.5K Likes – Neha Nagar Instagram

Caption : 3 Things to do before watching Animal. Otherwise, you will suffer huge losses. ✅ Fill Nominee Details for Your Assets: -Ensure you’ve nominated beneficiaries for all your assets including demat account by December 31st. -Nominating your demat account ensures that your loved ones can access and manage your assets in case of your passing. Without a nomination, the process of transferring your assets to your heirs can be lengthy and complicated. ✅Update Aadhaar Card Details for Free: -Update your Aadhaar card details like address and phone number using the UIDAI website or visiting an Aadhaar Seva Kendra before December 14th. -Delaying the update will incur charges after December 14th. ✅Use UPI at Least Once: -NPCI has announced that all inactive UPI IDs will be deactivated by December 31st, 2023. This means if you haven’t used your UPI ID to make any transaction in a year. -Make at least one transaction using your UPI app before to avoid account deactivation. ✅. Reactivate Your PAN Card : -Approximately 11.5 crore PAN cards are deactivated due to non-linked Aadhaar. -If your PAN card is deactivated, you’ll need to pay a penalty of Rs 1,000 to reactivate it. ✅. Revise Your Locker Agreement with Banks: -New RBI guidelines require all banks to revise their locker agreements with customers. This means you need to review and update your current agreement as per the latest guidelines. -The deadline for this update is December 31, 2023. To avoid any disruptions or complications, it’s crucial to take action before then. So if you haven’t done any of these, do it now before 31st to avoid extra charges and penalties.Likes : 137526

132.1K Likes – Neha Nagar Instagram

Caption : ₹80,000 Crore Await : Claim Your Unclaimed Investments ! Did you know? Over ₹80,000 crore worth of unclaimed shares and mutual funds lie dormant in India, potentially belonging to you or your loved ones. Why does this happen? Often, investments are made without informing family members, leading to their unawareness upon the investor’s passing. But there’s hope! SEBI, the market regulator, launched a centralised system to help reclaim these forgotten assets. Here’s how it works: 1.Gather documents: Death certificate and PAN card of the deceased family member. 2.Connect with any Stockbroker or Mutual Fund house: Share the gathered documents. 3.SEBI-registered KYC agency verifies: They confirm legal heirship and asset ownership. 4.Unclaimed wealth transferred: Stocks, mutual funds, bonds, etc., reach rightful beneficiaries. Remember: Timely and informed investment disclosure within families is crucial to avoid such situations. Follow @iamnehanagar for the next part !Likes : 132100

131.4K Likes – Neha Nagar Instagram

Caption : We are planning for our next family member after Siya ! Hold on, family planning isn’t quite on the agenda! But we are excited to unveil a tax-saving strategy that might sound surprising. Introducing HUF (Hindu Undivided Family), our legal partner in unlocking significant tax benefits. The Situation: * We, like many families, earn more than the ₹7 lakh tax-free limit in India. * Seeking guidance, My husband CA Deepak Bhati recommended a unique approach: “creating” another family member…but only on paper,of course! Enter HUF: * This separate legal entity, with its own PAN card and bank account, becomes an extension of our family. But who manages its affairs? That’s where Karta steps in! * The Karta: The head of the HUF, typically the eldest member, plays a crucial role in Decision-making and Legal representation. * HUF can share our family business income and rental income. * HUF can also invest in Stocks,MF,Properties etc. * By strategically splitting our income, we can significantly reduce our overall tax burden! (We will same Rs 55,000) Beyond Tax Savings: * HUF enjoys access to most tax benefits like 80C and NPS deductions etc, further maximising our financial advantage. * It establishes a separate legal identity, keeping our finances organised and streamlined. Important Notes: * HUF cannot claim salary income and the 87A rebate. * Only Buddhists, Jains, Hindus and Sikhs are eligible to form HUF. * Establishing and maintaining HUF involves legal considerations, so professional guidance is crucial. Drop a “HUF” in the comments, and I’ll send you detailed information about HUF. Follow @iamnehanagar for more such videos .Likes : 131366

![Neha Nagar - 123.2K Likes - 🚨Most Indian parents are making this mistake!!

Many aren’t planning enough for their child’s education, even though costs are rising fast. Education fees are going up by 10-15% each year, much faster than general inflation.

By the time your child is ready for college, the fees might be too high to handle.

For example, IIM fees have jumped from ₹5 lakhs in 2009 to ₹20 lakhs today!

Traditional investments like PPF or Sukanya accounts only give returns of 7-8%.

To keep up with rising costs, think about investing in index funds. While PPF might grow to ₹43 lakhs in 15 years, index funds could reach up to ₹84 lakhs.

Don’t wait—start planning and investing now to make sure you can afford your child’s education.

[ FinancialMistakes EducationCosts SmartInvesting FuturePlanning ]](https://www.gethucinema.com/wp-content/uploads/2025/01/Neha-Nagar-2-R0pb6C5641.jpg)

123.2K Likes – Neha Nagar Instagram

Caption : 🚨Most Indian parents are making this mistake!! Many aren’t planning enough for their child’s education, even though costs are rising fast. Education fees are going up by 10-15% each year, much faster than general inflation. By the time your child is ready for college, the fees might be too high to handle. For example, IIM fees have jumped from ₹5 lakhs in 2009 to ₹20 lakhs today! Traditional investments like PPF or Sukanya accounts only give returns of 7-8%. To keep up with rising costs, think about investing in index funds. While PPF might grow to ₹43 lakhs in 15 years, index funds could reach up to ₹84 lakhs. Don’t wait—start planning and investing now to make sure you can afford your child’s education. [ FinancialMistakes EducationCosts SmartInvesting FuturePlanning ]Likes : 123203

121.1K Likes – Neha Nagar Instagram

Caption : Get your dream home at a discounted price at auction! Do you dream of owning a home in Goa or Mumbai but the prices are too high? Don’t worry, there’s a way to get your dream home at a discounted price Through auction ! When borrowers can’t repay their loans, banks put the mortgaged properties up for auction. These properties are typically sold for 10-30% less than their market value, so you can save a significant amount of money. To find auction properties, you can visit the IBAPI website or other auction websites such as E auction India, Foreclosure, and Find auction. Once you’ve found a property that you’re interested in, you can contact the authorized authority to learn more about the auction process. Here are some tips for buying property at auction: • Do your research. Before you bid on any property, be sure to do your research to understand the market value of the property and any potential problems. • Be prepared to act quickly. Auctions can move quickly, so be prepared to act fast if you see a property that you want. • Have your finances in order. Before you bid on a property, make sure that you have the financial resources to pay for the purchase price, closing costs, and any necessary repairs. Buying property at auction can be a great way to save money on your dream home. Visit the IBAPI website today to start browsing auction properties in Goa, mumbai and other cities across India! #finance #property #nehanagarLikes : 121104

112.7K Likes – Neha Nagar Instagram

Caption : Give Your Family Freedom with UPI Circle on the BHIM App! Now you can make it easy for your family members to pay from their own phones while the money is securely deducted from your account! With UPI Circle, your loved ones can pay for school, groceries, or anything else—even if you aren’t there. 💡 How to Get Started: Update Your BHIM App: Make sure you have the latest version to access UPI Circle. Add Family Members: You can add family members to your UPI Circle, allowing them to make payments directly from their phone while funds are deducted from your account. Once added, they’ll receive a notification. With a quick confirmation, they gain access to UPI Circle for seamless transactions. Choose Your Control: Partial Delegation: Keep control by approving each payment with your UPI PIN. Full Delegation: Give full control to your family member to make payments, while you get notified after each transaction. With UPI Circle, managing family payments is simple, safe, and flexible. Download or update your BHIM App now to get started! #upicircleonBHIM #upicircle #upi #newlaunch #BHIM #downloadBHIM #MyFirstUPITransactionLikes : 112719

106.8K Likes – Neha Nagar Instagram

Caption : The Hidden Tax Burden of Buying a Home: Tax Series Part 1 When purchasing a house, buyers often focus on the property’s price tag. but, the actual cost can be significantly higher due to various taxes imposed by the government. Let’s break down the tax burden using the example of buying a 2 crore rupee flat in Delhi: 1. Income Tax Income Tax: Approximately 69 lakh rupees (34.5% of the property value) 2. Property Purchase Taxes Once you have the money, buying the property incurs additional taxes: Goods and Services Tax (GST): 5% = 10 lakh rupees Stamp Duty: 6% = 12 lakh rupees Tax Deducted at Source (TDS): 1% = 2 lakh rupees Registration Charges: 1% = 2 lakh rupees Total taxes on purchase: 26 lakh rupees (13% of the property value) 3. Future Sale Taxes If you decide to sell the property in the future: Long Term Capital Gains Tax: 12.5% The Bottom Line To buy a 2 crore rupee house: Total taxes paid: 95 lakh rupees (47.5% of the property value) This means that nearly half of what you pay goes directly to the government in various forms of taxation. The government benefits significantly from property transactions, collecting taxes at multiple stages of the process. Do you think the government needs to lower the taxes? PS: We are starting a new series related to tax that saves you a lot of money, follow me for that!Likes : 106815

106.7K Likes – Neha Nagar Instagram

Caption : Parents, let’s rethink the school choice: Expensive schools might offer prestige, but they often come with hidden costs and added pressures for kids. Instead of stretching your budget, consider a school that fits your means and invest the extra in developing your child’s skills. This way, you’re nurturing both their confidence and growth! There are many schools that provide great education without breaking the bank! Let me know some of your recommendations in the comments! 💬👇 #finance #education #inflation #nehanagar #schoolLikes : 106687

105.8K Likes – Neha Nagar Instagram

Caption : Hey Fin-woman, why did the stock market fall so much today? There are 3 main reasons why the stock market fell: 1.Sebi Chairman Madhabi Puri warned yesterday that midcap and smallcap stocks are overvalued and in a bubble, after which ICICI mutual fund stopped lump sum investment in its smallcap and midcap funds. That’s why both indexes are down 5% today and our portfolio is even more !! 2.US inflation increased significantly in February and inflation in India is also showing no signs of pause, so investors are worried that the US and Indian governments may raise interest rates instead of lowering them. 3.March is ending and the financial year is about to end, so big investors are selling their profitable and loss-making stocks together at this time, so that their profits and taxes are reduced. So are you in favour of selling or buying stocks right now, tell me in the comments.Likes : 105772

104.7K Likes – Neha Nagar Instagram

Caption : 2024 : Finance Influencer Award by @gadkari.nitin 2020 : My family told me to not make videos. I Started making finance content on short video platform Tiktok in Lockdown 2020. when there was 99% entertainment content only & almost nothing particularly on finance. So they said why will people watch Finance content on TT they just want to get entertained here. But still I posted few videos on taxes & investing And to my surprise they all went viral within a week. Then I added 300k followers in 2 months on Tiktok. We all were surprised & super happy that it worked. But then TT got banned on 29th June. And there I realised the importance of diversification. I had everything on one platform. Nothing on others. And I had to start from zero. It was a difficult time. But I started again on Instagram. And again I got 600k followers in first 6 months only. Finance content started picking up too fast…But this time I started working on Youtube, Linkedin & Twitter too. And now here we are in 2024 getting an Award from my favorite politician/govt official on biggest platform. And Thank you so much @enavabharat for appreciating our work.. ❤️❤️🥹🥹🥹❤️❤️ Thank you my Finfamily for everything.Likes : 104704

100.5K Likes – Neha Nagar Instagram

Caption : ₹4 lakh school fees for LKG students 😱 One school in Hyderabad wants 4 lakh rupees for LKG fees. That’s a lot! Education costs are going up by 12% every year. But why so much money? Well, I don’t know!! But I’ve decided to send my child to a normal school from nursery to 12th grade. In India, all schools teach the same things till 12th grade. Go NCERT! For higher education, my partner Deepak and I are saving money. We’re putting 13,000 rupees every month into an investment that gives us 12% back every year. This should help us handle the rising cost of education. Financial planning for a child’s education is essential for securing their future. Here are some steps you can take: -Set Goals: Determine the type of education you want for your child and estimate the associated costs. Consider factors such as tuition fees, books, accommodation, and extracurricular activities. -Start Early: The earlier you begin saving, the better. Compound interest can significantly boost your savings over time. – Create a Budget: Analyse your current financial situation and create a budget that allocates funds specifically for your child’s education. Follow for more.Likes : 100487

![Neha Nagar - 99.6K Likes - Deepak and I believe that a couple that manages their finances together grows together.

While I know talking about money matters might not seem exactly romantic, having a stable financial base is definitely one factor that can help a relationship go the distance.

If you are also a couple, here are a few things you can do :

1️⃣ Communicate Openly:

-Discuss your financial goals, spending habits, and budget.

-Have regular money talks to stay aligned and avoid misunderstandings.

2️⃣ Create a Joint Budget:

-Establish a monthly budget that covers all shared expenses.

-Use a fixed ratio based on income to contribute to household costs.

3️⃣ Separate and Joint Accounts:

-Maintain individual accounts for personal spending.

-Have a joint account for shared expenses and an emergency fund.

4️⃣ Plan for the Future:

-Make a joint financial plan for retirement, travel, and other big goals.

-Regularly review and adjust your plans as needed.

5️⃣ Optimize Taxes:

-Take assets and debt in joint names to save on taxes.

6️⃣ Respect Spending Differences:

-Understand and respect each other’s spending habits.

-Find a balance that works for both of you.

By talking about your finances openly and honestly, you can avoid misunderstandings, disagreements, and financial stress.

So, don’t shy away from talking about money with your partner, and work together to achieve your financial dreams.

If you also want to learn about how to build wealth as a family, then check out the link in my bio.

[ Couplefinance relationship money investing tax ]](https://www.gethucinema.com/wp-content/uploads/2025/01/Neha-Nagar-6-uVmi628725.jpg)

99.6K Likes – Neha Nagar Instagram

Caption : Deepak and I believe that a couple that manages their finances together grows together. While I know talking about money matters might not seem exactly romantic, having a stable financial base is definitely one factor that can help a relationship go the distance. If you are also a couple, here are a few things you can do : 1️⃣ Communicate Openly: -Discuss your financial goals, spending habits, and budget. -Have regular money talks to stay aligned and avoid misunderstandings. 2️⃣ Create a Joint Budget: -Establish a monthly budget that covers all shared expenses. -Use a fixed ratio based on income to contribute to household costs. 3️⃣ Separate and Joint Accounts: -Maintain individual accounts for personal spending. -Have a joint account for shared expenses and an emergency fund. 4️⃣ Plan for the Future: -Make a joint financial plan for retirement, travel, and other big goals. -Regularly review and adjust your plans as needed. 5️⃣ Optimize Taxes: -Take assets and debt in joint names to save on taxes. 6️⃣ Respect Spending Differences: -Understand and respect each other’s spending habits. -Find a balance that works for both of you. By talking about your finances openly and honestly, you can avoid misunderstandings, disagreements, and financial stress. So, don’t shy away from talking about money with your partner, and work together to achieve your financial dreams. If you also want to learn about how to build wealth as a family, then check out the link in my bio. [ Couplefinance relationship money investing tax ]Likes : 99637

96.4K Likes – Neha Nagar Instagram

Caption : 1 crore homes will get solar panels in India !! This gift was given by PM Narendra Modi after returning from Ram Mandir, by announcing the Pradhan Mantri Suryodaya Yojana. Currently, we get up to 40% subsidy under the government’s Rooftop Solar Program, using which 7 to 8 lakh households have installed solar panels. But this is the case with those people who can afford solar rooftop, but the middle class and lower middle class are still away from this scheme. And this gap will be filled by the Pradhan Mantri Suryodaya Yojana by installing solar rooftops on 1 crore houses. Because if we believe the report of the Council of Energy, then 25 crore Indian households are capable of installing solar panels, which can fulfil India’s electricity demand 3 times. Eligibility criteria for this scheme have not been announced yet . To apply for this scheme, check the government’s National Portal for Rooftop Solar and follow @iamnehanagar to master your money!Likes : 96418

86.2K Likes – Neha Nagar Instagram

Caption : Rich people don’t rely on savings alone for their kids’ future. With inflation rising (6% retail, 14% education) and bank savings giving just 2-3% returns, your money isn’t growing fast enough to secure a bright future for your child. That’s why *investing* is the smarter choice. The earlier you start, the more your money can grow through compounding. 🚀 Here are 3 smart options I’ve invested in: 1️⃣ Govt SSY (Sukanya Samriddhi Yojana):** 8% tax-free returns, zero risk. A ₹5,000 monthly SIP = ₹24 lakh in 18 years. 2️⃣ Index Funds: 15-16% average long-term returns. A ₹5,000 monthly SIP = ₹62 lakh in 18 years. 3️⃣ NPS Vatsalaya Scheme: 12-13% tax-free returns. A ₹5,000 SIP = ₹38 lakh in 18 years. Don’t let your savings fall behind — invest in your child’s future today!💡 Comment CHILD, and I’ll share all the details #childplanning #education #nehanagarLikes : 86174

80.4K Likes – Neha Nagar Instagram

Caption : Personal Choice 👏😻Likes : 80361

79.4K Likes – Neha Nagar Instagram

Caption : What else ? We need to learn investing. Investing on right time, investing on right people, investing on skills. Quotes from @researchinandoutLikes : 79390

76.2K Likes – Neha Nagar Instagram

Caption : 13 year old me was just like me today. The only difference is now I have clarity. Clarity to what I want or what I don’t want. Clarity that helps me to make peace with everything in life. 13 yr old me was restless , not so confident kid. But after a decade , after many failures & some achievements. The restlessness isn’t bothering me but no matter what I do or what I achieve , I still kind of underestimate everything I do. I still think this isn’t enough. We all do this to ourselves. Don’t we ? But today, I made myself proud. My parents proud . My supporters( you ) proud that they were right about me when I myself was doubtful. This is giving me some different kind of energy to keep going. To keep doing what I do, to keep thinking what I think (Or overthink ) because today I know I am not going to stop. I will keep going. Forbes feature is huge for me !! Huge !! Can’t thank you everyone enough. This is to us ! For constantly coming here to show up support & to give value to each other. This is to my family for everything. I aim to make everyone (1.1 M )who follows me financially literate. Let’s make our world better by mastering our own money. Cheers 🥂 happy to get featured along with @komalpandeyofficial @techburner @kalambemalharLikes : 76225

74.1K Likes – Neha Nagar Instagram

Caption : Buying a car in India is not just about the car’s price; it’s about how much extra you pay in taxes! Let’s take an example: Sharma ji’s son wants to buy a car worth ₹26 lakh (like a Scorpio-N). But to actually afford it, he needs to earn ₹35 lakh. Why? Because: ₹9 lakh out of his ₹35 lakh income will go to the government as income tax. Now, let’s break down the cost of the car: 1️⃣ The actual price of the car is ₹15 lakh. 2️⃣ On top of that, there’s: 🔸 28% GST on the car 🔸 22% Cess 🔸 18% GST on insurance 🔸 ₹2.5 lakh as road tax In total, he’ll pay ₹19 lakh in taxes for a ₹26 lakh car! So, when you buy a car, you’re not just buying it for yourself—you’re paying a hefty sum to the government too. What do you think about these taxes? Share your thoughts! #CarTaxes #IndianEconomy #Taxation #CarBuying #FinancialAwareness #GST #RoadTax #IncomeTax #MoneyMatters #ThinkBeforeYouBuy #PersonalFinanceLikes : 74116

73.1K Likes – Neha Nagar Instagram

Caption : Get a full refund on the stolen car! Did you know over 1 lakh cars are stolen every year in India, with a whopping 56% of cases concentrated in Delhi NCR alone? Bengaluru and Chennai also see a significant number of thefts, at 9% and 5% respectively. While standard insurance helps, it often settles based on Insured Declared Value (IDV), which never reflects your car’s full worth. **Here’s where a Return To Invoice (RTI) add-on can be your hero** What is RTI? RTI is an add-on for your car insurance that provides the full invoice value for your car in case of theft or irreparable damage. This includes: * Car purchase price * RTO charges * Road tax Why is RTI important, especially in high-risk cities like Delhi NCR, Bengaluru, and Chennai? * Maximises payout: Get the complete value you paid for your car, not just the depreciated IDV. * Peace of mind: Focus on recovery, not financial loss, in a stressful situation. * Important Note : RTI cover is only available for vehicles which are less than 3 years old. And follow @iamnehanagar for more such insightful videos.Likes : 73142

70.6K Likes – Neha Nagar Instagram

Caption : #AwaazPodcast मे देखिए अनुज सिंघल की खास बातचीत नेहा नागर के साथ। #Podcast #FilmyFinance #Awaazspecial #ShareMarketLikes : 70644

69.4K Likes – Neha Nagar Instagram

Caption : Red flags in a relationship!!Likes : 69365

69.3K Likes – Neha Nagar Instagram

Caption : Groww Controversy Explained What Happened: In June 2024, a social media post went viral accusing Groww, an investment app, of taking money from a user’s account without making an investment. The user said they invested in a mutual fund through Groww, but couldn’t redeem it. They also claimed that Groww gave them a fake folio number for the investment. Groww’s Response: At first, Groww responded by giving back the disputed amount to the user as a goodwill gesture. They also mentioned that they were looking into the issue and would take necessary actions. Later, Groww also mentioned user never actually made the investment and no money was taken from their account. They explained the issue was due to a “reconciliation problem,” which made the user’s dashboard show incorrect information. Key Lessons: Check for Confirmation Emails: When you invest, you should get a confirmation email from the mutual fund house. Always check these emails and save them for your records. Review Investment Statements: Regularly check the quarterly statements from your broker. These show what investments you hold. Make sure they are correct. Use the CAMS App: The CAMS app helps track your mutual fund investments. It shows your portfolio, transaction history, and other important information Follow for moreLikes : 69257

66.9K Likes – Neha Nagar Instagram

Caption : Thinking of starting a family? Here’s a reality check on what it costs to welcome a baby! 👶 Pregnancy, delivery, and all those first-year expenses can really add up! 💸 Pregnancy costs: For a normal pregnancy:₹50K IVF: ₹1-2L (pre-delivery expenses) 👶 Delivery costs: Normal: ₹60-80K C-Section: ₹1-1.3L Once your little one arrives, the costs continue. Between baby care, vaccinations, and that all-important first birthday celebration, you’re looking at another ₹1.8L in just the first year! From the second year onward, monthly expenses could rise by 20–30%, adding around ₹30K if your current costs are ₹1L per month. And with medical inflation in India at 14%, these numbers will only climb each year. It’s smart to have at least ₹3-4L saved to ease the transition. Share this reel with those about to get married. #FamilyPlanning #ParenthoodFinance #FinancialTips #BabyBudget #NehaNagar”Likes : 66857

66.4K Likes – Neha Nagar Instagram

Caption : 🚨 Don’t wait for a scam to ruin your life! Did you know Sunny Leone is reportedly receiving ₹1,000 per month from a government scheme? But hold on—it’s not what it seems! A scammer opened a fake bank account in her name using forged Aadhaar and PAN details to illegally claim government benefits. Such scams can happen to anyone, including YOU! Protect yourself by following these simple steps: 🛡️ Check Your Aadhaar Usage -Log in to the Aadhaar portal. -Use the “Aadhaar Authentication History” feature to track where and when your Aadhaar has been used. -If you see any suspicious activity, report it to UIDAI immediately. 🛡️ Monitor Your PAN Card -Your PAN is often linked to financial activities and can be misused for unauthorized loans or transactions. -Regularly check your CIBIL report on trusted platforms like CIBIL.com. -Spot any loans or credit you didn’t authorize? Report it right away to prevent further misuse. 🛡️ Verify Mobile Numbers Linked to Adhere -Visit the TAFCOP portal to see all mobile numbers registered under your Aadhaar. -If there are any numbers you don’t recognize, report them to authorities immediately. By staying vigilant and taking these steps, you can secure your financial identity and avoid falling victim to scams. 👉 Have you checked your Aadhaar and PAN usage recently? #Scam #nehanagar #pancardscam #sunnyleone #aadhaarcardLikes : 66370

63.7K Likes – Neha Nagar Instagram

Caption : Recently, I narrowly escaped one of the most common types of scams: Clicking on unknown links. Scammers call people and claim that their utility bills are overdue. They threaten to cut off services like electricity or phone unless you pay up immediately. They’ll even send a link to your phone for payment. But don’t be fooled! Once you pay, your money is gone. Here’s what you should do: – Always double-check the authenticity of the caller. – Pay bills only through trusted sources. – Don’t fall for bill payment demands from unknown callers or texts. – And whatever you do, don’t download any unfamiliar apps and never click on any unknown links. Remember, UPI is safe, but we must take care of our money, ourselves. Share this information with your friends and family. #GyaanSeDhyaanSe #upi #upichalegaLikes : 63721

60.7K Likes – Neha Nagar Instagram

Caption : Samjhe ?Likes : 60746

60.5K Likes – Neha Nagar Instagram

Caption : Red Flag in a Relationship ( Male Version )Likes : 60525

![Neha Nagar - 59.5K Likes - Will gold prices cross 1 lakh rupees?

Gold has long been considered a safe-haven asset, and recent trends suggest it could be on the rise, because of these 3 possible reasons :

1. Increased Central Bank Buying:

Over the past year, both China and India’s central banks have been significantly increasing their gold reserves. China alone has witnessed a 16% rise in its gold reserves in the last year. Meanwhile, our own Reserve Bank of India (RBI) has been proactive, purchasing as much gold in the first three months of this year as it did in the entire previous year.

2. Geopolitical Tensions:

Recent escalations in tensions between Israel and Iran have prompted investors to seek refuge in gold. Historically, during times of war or recession, investors tend to divest from the stock market and flock towards safe-haven assets like gold.

3. Diversification from the Dollar:

Major global players such as Russia, China, and India may adopt the Dollar 1 strategy. This entails reducing dependency on the US dollar by conducting a significant portion of their international trade in gold rather than dollars. This move could potentially decrease their vulnerability to fluctuations in the US dollar.

What do you think? Let me know in the comments.

[ Goldprices Nehanagar finance Investing dollar ]](https://www.gethucinema.com/wp-content/uploads/2025/01/Neha-Nagar-12-voUtG67913.jpg)

59.5K Likes – Neha Nagar Instagram

Caption : Will gold prices cross 1 lakh rupees? Gold has long been considered a safe-haven asset, and recent trends suggest it could be on the rise, because of these 3 possible reasons : 1. Increased Central Bank Buying: Over the past year, both China and India’s central banks have been significantly increasing their gold reserves. China alone has witnessed a 16% rise in its gold reserves in the last year. Meanwhile, our own Reserve Bank of India (RBI) has been proactive, purchasing as much gold in the first three months of this year as it did in the entire previous year. 2. Geopolitical Tensions: Recent escalations in tensions between Israel and Iran have prompted investors to seek refuge in gold. Historically, during times of war or recession, investors tend to divest from the stock market and flock towards safe-haven assets like gold. 3. Diversification from the Dollar: Major global players such as Russia, China, and India may adopt the Dollar 1 strategy. This entails reducing dependency on the US dollar by conducting a significant portion of their international trade in gold rather than dollars. This move could potentially decrease their vulnerability to fluctuations in the US dollar. What do you think? Let me know in the comments. [ Goldprices Nehanagar finance Investing dollar ]Likes : 59468

59K Likes – Neha Nagar Instagram

Caption : 3 reasons behind stock market crash !!Likes : 59019

58.9K Likes – Neha Nagar Instagram

Caption : Tere bina na Guzara ❤️❤️❤️Likes : 58866

58.9K Likes – Neha Nagar Instagram

Caption : Tere bina na Guzara ❤️❤️❤️Likes : 58866

58.9K Likes – Neha Nagar Instagram

Caption : Tere bina na Guzara ❤️❤️❤️Likes : 58866

58.9K Likes – Neha Nagar Instagram

Caption : Tere bina na Guzara ❤️❤️❤️Likes : 58866

58.9K Likes – Neha Nagar Instagram

Caption : Tere bina na Guzara ❤️❤️❤️Likes : 58866

58.9K Likes – Neha Nagar Instagram

Caption : Tere bina na Guzara ❤️❤️❤️Likes : 58866

58.9K Likes – Neha Nagar Instagram

Caption : Tere bina na Guzara ❤️❤️❤️Likes : 58866

58.9K Likes – Neha Nagar Instagram

Caption : Tere bina na Guzara ❤️❤️❤️Likes : 58866

58.9K Likes – Neha Nagar Instagram

Caption : Tere bina na Guzara ❤️❤️❤️Likes : 58866

58.9K Likes – Neha Nagar Instagram

Caption : Tere bina na Guzara ❤️❤️❤️Likes : 58866

57.2K Likes – Neha Nagar Instagram

Caption : As parents, we made a thoughtful decision not to host a traditional birthday party. Instead, we wanted to focus on instilling values that would shape her understanding of gratitude and simplicity from the very beginning, here is why Choosing Values Over Excess: Rather than indulging in extravagant celebrations with lavish gifts, we opted to emphasize the importance of appreciating meaningful experiences over material possessions. This decision reflects our belief that fostering gratitude and humility early on will guide her towards a more fulfilling life. Creating Meaningful Traditions: In place of elaborate parties, we initiated a new tradition centered around enriching experiences. This year, we took our daughter to Vrindavan, a place of spiritual significance. Here, we engaged in activities like meditation, yoga, and selfless service (seva) as a family. These activities not only deepened our bonds but also imparted invaluable lessons about mindfulness and compassion. Long-Term Benefits: Beyond the immediate savings in terms of money, this approach offers enduring benefits for our daughter’s emotional and personal development. By nurturing a sense of gratitude and simplicity, we aim to equip her with resilience and empathy, preparing her to navigate life’s challenges with grace and understanding. Follow for moreLikes : 57247

56.6K Likes – Neha Nagar Instagram

Caption : 5 best things you can do for your child. Read Caption. 1. Open a separate bank account as soon as they are born, keep all their shagun money in the account & then plan to invest in somewhere. Add 10-15 % of your income in this account to invest for their future. 2. Start investing & diversifying: You can invest in Index funds ( risky ) for long term goals ( higher education, marriage), you can invest in govt schemes ( risk free ) like sukanya samridhi yojana / PPF / Post office term deposit etc ( will talk about these next few reels – so hit that like/save button ) 3. As they grow , start giving them some allowance- let them make mistakes, teach them value of money.. Let them budget for themselves & save. Let them decide where to spend their limited money. Take them to grocery shopping as well. Let them plan it. Talk about how you go to work to earn some money for family. 4. When they turn 13 or so, include them in your financial discussions. They will be able to learn how to make money decisions. Give them options: buy an expensive car & cut down on vacations or we should buy a small car & enjoy more vacations ? 5. Insure : You must take health insurance for everyone in the family including your new born, and take life insurance for the earning member in the family. Also don’t forget to add nominees in all your belongings. Will add more details here soon. Hit that follow button & wait for my next reel 😊❤️ #nehanagar #personalfinance #masteryourmoneyLikes : 56583

![Neha Nagar - 56K Likes - The toll Passes have NOT been launched yet!

The National Highways Authority of India (NHAI) is set launch a new Toll Pass system, allowing you to use highways and expressways without worrying about your Fastag balance. Say goodbye to last-minute recharges and enjoy seamless road trips!

What Are the New Toll Passes?

✅ ₹3000 Toll Pass – Unlimited access to all highways & expressways for 1 year

✅ ₹30,000 Toll Pass – Unlimited access for 15 years

Why Should You Get a Toll Pass?

✔ No more recharges – Travel without worrying about balance

✔ No extra charges – Pay once and use highways freely

✔ Hassle-free travel – No interruptions due to low balance

✔ Available for all vehicles with Fastag

Where & How to Buy?

-These passes will be available soon on the NHAI portal.

- You can also purchase them through your Fastag bank.

This is a big step towards making highway travel easier and more convenient for everyone. No more unnecessary stops, just smooth and stress-free driving! 🚙💨

Tag your friends who always check their Fastag balance at the last moment! 😂👇

[TollFreeDrive NHAI Fastag SmoothTravel NehaNagar]](https://www.gethucinema.com/wp-content/uploads/2025/02/Neha-Nagar-8-H8IUb11552.jpg)

56K Likes – Neha Nagar Instagram

Caption : The toll Passes have NOT been launched yet! The National Highways Authority of India (NHAI) is set launch a new Toll Pass system, allowing you to use highways and expressways without worrying about your Fastag balance. Say goodbye to last-minute recharges and enjoy seamless road trips! What Are the New Toll Passes? ✅ ₹3000 Toll Pass – Unlimited access to all highways & expressways for 1 year ✅ ₹30,000 Toll Pass – Unlimited access for 15 years Why Should You Get a Toll Pass? ✔ No more recharges – Travel without worrying about balance ✔ No extra charges – Pay once and use highways freely ✔ Hassle-free travel – No interruptions due to low balance ✔ Available for all vehicles with Fastag Where & How to Buy? -These passes will be available soon on the NHAI portal. – You can also purchase them through your Fastag bank. This is a big step towards making highway travel easier and more convenient for everyone. No more unnecessary stops, just smooth and stress-free driving! 🚙💨 Tag your friends who always check their Fastag balance at the last moment! 😂👇 [TollFreeDrive NHAI Fastag SmoothTravel NehaNagar]Likes : 55983

55.5K Likes – Neha Nagar Instagram

Caption : Growing up, my parents had it tough financially, but they still made sure we had a good life. They bought a home and a car while making many sacrifices. They always chose tap water over bottled at restaurants and shopped at local markets instead of malls? They’d mend a torn shirt and reuse it and wore the same saree to many weddings. They compared our grades to Sharma ji’s kids but never showed off their own successes. Why? They understood the difference between needs and wants. Today, we often compare ourselves to others on social media and spend on the latest gadgets and trips, forgetting what we truly need. Let’s take a moment to appreciate the simple joys and the important lessons our parents taught us.Likes : 55531

55.2K Likes – Neha Nagar Instagram

Caption : All the details for Lakshadweep: ‼️ Protected Area Permit (PAP): 📌 Application Process: • You can apply for the PAP online through the e-permit portal of the Lakshadweep Administration (http://www.lakshadweeptourism.com/contact.html). • The application requires basic information like your name, address, purpose of visit, travel dates, and chosen islands. • You can upload scanned copies of your ID proof and passport-sized photograph. • Once submitted, the application is processed within 7 working days. You’ll receive an email notification with the permit status. 📌 Validity and Fees: • The PAP is valid for 30 days from the date of issue. • The permit fee is ₹300 per person for all ages. 📌 Details: • You can choose the specific islands you want to visit during your application. • Carry a printed copy of the approved PAP along with your valid ID proof while traveling. • Certain islands within Lakshadweep might require additional permits for specific activities like scuba diving or wildlife photography. Check with the respective island authorities for details. 📌 Transportation: • Flights: Delhi to Kochi- costs 12k (round trip). • Ferry: Inter-island transfers range from ₹4,000-8,000 per person (two-way). 📌 Accommodation: • Budget: Agatti Island has guesthouses for ₹1,500-2,500 per night. • Moderate: Bangaram Island offers cottages at ₹15,000 per night (all-inclusive). • Luxury: Kavaratti has air-conditioned suites for ₹9,000 per night (all-inclusive). 📌 Water Activities: – Canoeing At Minicoy Island – Water sports: Snorkeling starts at ₹500, scuba diving at ₹2,500, and fishing tours at ₹1,000. – Sightseeing: Island tours cost around ₹500-1,000 per person. 📌 More activities: – Visit local villages, witness traditional boat building, and enjoy Maldivian dance performances. – Get Ayurvedic massages and spa treatments for ultimate relaxation. 📌 Permits and Taxes: • Permit: A mandatory ₹300 entry permit is required for non-Indians. • Green Tax: ₹300 per person is levied upon arrival at Agatti airport. 📌 Best time to visit: October to February is the best time to travel!Likes : 55197

54.3K Likes – Neha Nagar Instagram

Caption : Want to invest in Real estate in India? Here’s a big insight. As per emerging reports, india will urbanise at a rate of 50% by 2050, and the benefit of it will be felt by investors who go for tier two cities. Here are a few considerations: ⚡️ Commercial properties or purchase of land in cities like Noida or Greater Noida. ⚡️ Residential, commercial, land or other real estate investments in cities like Bhubaneswar, Coimbatore, Indore, Jaipur, Kochi, Lucknow, Nagpur, Surat, Thiruvananthapuram and Visakhapatnam. ⚡️ Purchase of Land or Lease & rentals in beautiful locations across India for conversion into home-stays, Airbnbs, and for expansion of tourism. In recent times tier two cities such as Chandigarh, Vijayawada, Indore, Coimbatore, Visakhapatnam, and Nagpur have witnessed rapid growth in due to their strong industrial base, improved infrastructure, and large populations. Sources: Money Control and a report by Cushman and Wakefield, a real estate consultant and apex body of real estate developers Confederation of Real Estate Developers’ Associations of India (CREDAI) released on October 6 at the 21st NATCON {investment, real estate, india, real estate in india, emerging cities of india, future of india, commercial property, residential property, Airbnb}Likes : 54257

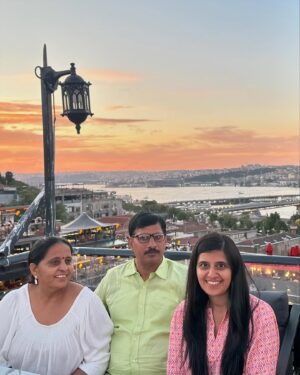

51.4K Likes – Neha Nagar Instagram

Caption : Are you stingy ? You keep talking about saving money. Save by not spending on big fat wedding, expensive photoshoot , big fat birthday celebrations. Why do hustle then ? The Answer : Middle Class Girl in me doesn’t let me spend on not so important stuffs even if I can afford them easily. Where do I plan to spend most of the earned money ? Travel My Parents took their first flight ever & went on a First international trip. Teenage Neha dreamed of taking her parents on their first international adventure, paying for their first flight tickets, showing them the beauty of the world, and most importantly, seeing them happy. Growing up saw them struggling financially but they always made their children’s education a priority.. And luckily we made them proud, but even after I was doing pretty good in my career . I couldn’t convince them to make me spend on them for a trip , but thankfully after 5-6 years. Me and Deepak were able to convince them. And we went on our first family trip. The trip got postponed multiple times but we kept on making efforts. And Believe me, the Happiness and Joy on their face were worth the struggle!!! This was a very big dream for me !! I am screaming and crying out of joy !! I want to thank every person who has been a part of my journey, directly or indirectly. This couldn’t have been achieved without you! ❤Likes : 51392

50.7K Likes – Neha Nagar Instagram

Caption : Meet our daughter Siya Bhati ❤️❤️❤️ She is about to be 2 now & I feel its high time that we introduce her to you all now.. Whats better way than using this CHATGPT GHIBLI feature 🤩💕Likes : 50709

50.7K Likes – Neha Nagar Instagram

Caption : Meet our daughter Siya Bhati ❤️❤️❤️ She is about to be 2 now & I feel its high time that we introduce her to you all now.. Whats better way than using this CHATGPT GHIBLI feature 🤩💕Likes : 50709

50.7K Likes – Neha Nagar Instagram

Caption : Meet our daughter Siya Bhati ❤️❤️❤️ She is about to be 2 now & I feel its high time that we introduce her to you all now.. Whats better way than using this CHATGPT GHIBLI feature 🤩💕Likes : 50709

50.7K Likes – Neha Nagar Instagram

Caption : Meet our daughter Siya Bhati ❤️❤️❤️ She is about to be 2 now & I feel its high time that we introduce her to you all now.. Whats better way than using this CHATGPT GHIBLI feature 🤩💕Likes : 50709

50.7K Likes – Neha Nagar Instagram

Caption : Meet our daughter Siya Bhati ❤️❤️❤️ She is about to be 2 now & I feel its high time that we introduce her to you all now.. Whats better way than using this CHATGPT GHIBLI feature 🤩💕Likes : 50709

50.7K Likes – Neha Nagar Instagram

Caption : Meet our daughter Siya Bhati ❤️❤️❤️ She is about to be 2 now & I feel its high time that we introduce her to you all now.. Whats better way than using this CHATGPT GHIBLI feature 🤩💕Likes : 50709

50.7K Likes – Neha Nagar Instagram

Caption : Meet our daughter Siya Bhati ❤️❤️❤️ She is about to be 2 now & I feel its high time that we introduce her to you all now.. Whats better way than using this CHATGPT GHIBLI feature 🤩💕Likes : 50709

50.7K Likes – Neha Nagar Instagram

Caption : Meet our daughter Siya Bhati ❤️❤️❤️ She is about to be 2 now & I feel its high time that we introduce her to you all now.. Whats better way than using this CHATGPT GHIBLI feature 🤩💕Likes : 50709

50.7K Likes – Neha Nagar Instagram

Caption : Meet our daughter Siya Bhati ❤️❤️❤️ She is about to be 2 now & I feel its high time that we introduce her to you all now.. Whats better way than using this CHATGPT GHIBLI feature 🤩💕Likes : 50709

50.7K Likes – Neha Nagar Instagram

Caption : Meet our daughter Siya Bhati ❤️❤️❤️ She is about to be 2 now & I feel its high time that we introduce her to you all now.. Whats better way than using this CHATGPT GHIBLI feature 🤩💕Likes : 50709

49.7K Likes – Neha Nagar Instagram

Caption : Married or not? Watch to know how to save money for the future! #personalfinance #marriage #financialeducation #finance #investment #coupleLikes : 49654

48.6K Likes – Neha Nagar Instagram

Caption : “Men are guilty until proven innocent” Here is how you can try to save yourself. And as per laws “Prenup” is also illegal in India! Prenup is a very popular tool in western countries. It is an agreement made between two people before marriage that establishes rights to property and support in the event of divorce or death. But in India, we can’t have a marriage in which we previously decided who gets what after divorce, as India is a pro-marriage country. Though prenups are not valid in India, we can create “Quasi-Prenups and Postnups.” We can draft this, fully knowing that we might not be able to limit the amount of alimony and interim maintenance that a wife can claim. However, there are many other aspects that these Quasi prenups and postnups help with. Often, several false allegations are made: About dowry demands. About wedding expenses. About jewellery and other gifts. About the true financial capacity of both sides. About the circumstances in which the wedding took place. These contracts are signed and then notarized by both parties for confirmation, and they act as a barrier for both parties in the event of false cases. Quasi Prenup -Legal contract of confirmation from both parties before marriage. Quasi Postnup – Legal contract of confirmation from both parties after marriage. 🚨Big Caution: Both prenup and postnup are important, as other parties can claim that these types of wrong demands happen after marriage By doing this,both parties think twice before filing false allegations. It also helps significantly in securing anticipatory bail, reducing alimony and maintenance claims, and defending compensation claims. Follow @iamnehanagar for more such informative videos.Likes : 48617

48.4K Likes – Neha Nagar Instagram

Caption : Dogecoin……..Bhaago!!Likes : 48368

45.7K Likes – Neha Nagar Instagram

Caption : Siya on her 4th team outing 🙂 Every employee deserves a company that treats them more than just employees—one that cares for them like a real family. Our team means everything to us. It’s not just about getting the work done; it’s about the bond we share that makes our journey special. Last week, we finished our fourth team outing in the last two years, this time to the beautiful hills of Manali. This trip brought us even closer and reminded us of why we value these moments together. When we arrived in Manali, everyone was amazed by the stunning mountains and the cool, crisp air. The peaceful vibe set the perfect tone for our trip. Our evenings were filled with fun as we played games like UNO and Damsharas, with everyone showing their playful side. It was great to see our team relaxing and enjoying each other’s company. The next day, we went on a hike to Jogini Waterfall. The hike was refreshing, and the waterfall was absolutely gorgeous. It was a moment to take in the beauty around us and think about how far we’ve come as a team. But beyond the fun, this trip was a reminder of what we stand for. we’re not just coworkers—we’re a family. We support each other, celebrate our wins, and help each other through tough times. These outings are our way of saying thank you to our team for all their hard work. It’s about creating memories beyond the office, building trust, and making everyone feel like they truly belong. I’m more sure than ever that a company’s success depends on how it treats its people. What do you think, let me know in the comment?Likes : 45725

45.7K Likes – Neha Nagar Instagram

Caption : Siya on her 4th team outing 🙂 Every employee deserves a company that treats them more than just employees—one that cares for them like a real family. Our team means everything to us. It’s not just about getting the work done; it’s about the bond we share that makes our journey special. Last week, we finished our fourth team outing in the last two years, this time to the beautiful hills of Manali. This trip brought us even closer and reminded us of why we value these moments together. When we arrived in Manali, everyone was amazed by the stunning mountains and the cool, crisp air. The peaceful vibe set the perfect tone for our trip. Our evenings were filled with fun as we played games like UNO and Damsharas, with everyone showing their playful side. It was great to see our team relaxing and enjoying each other’s company. The next day, we went on a hike to Jogini Waterfall. The hike was refreshing, and the waterfall was absolutely gorgeous. It was a moment to take in the beauty around us and think about how far we’ve come as a team. But beyond the fun, this trip was a reminder of what we stand for. we’re not just coworkers—we’re a family. We support each other, celebrate our wins, and help each other through tough times. These outings are our way of saying thank you to our team for all their hard work. It’s about creating memories beyond the office, building trust, and making everyone feel like they truly belong. I’m more sure than ever that a company’s success depends on how it treats its people. What do you think, let me know in the comment?Likes : 45725

45.7K Likes – Neha Nagar Instagram

Caption : Siya on her 4th team outing 🙂 Every employee deserves a company that treats them more than just employees—one that cares for them like a real family. Our team means everything to us. It’s not just about getting the work done; it’s about the bond we share that makes our journey special. Last week, we finished our fourth team outing in the last two years, this time to the beautiful hills of Manali. This trip brought us even closer and reminded us of why we value these moments together. When we arrived in Manali, everyone was amazed by the stunning mountains and the cool, crisp air. The peaceful vibe set the perfect tone for our trip. Our evenings were filled with fun as we played games like UNO and Damsharas, with everyone showing their playful side. It was great to see our team relaxing and enjoying each other’s company. The next day, we went on a hike to Jogini Waterfall. The hike was refreshing, and the waterfall was absolutely gorgeous. It was a moment to take in the beauty around us and think about how far we’ve come as a team. But beyond the fun, this trip was a reminder of what we stand for. we’re not just coworkers—we’re a family. We support each other, celebrate our wins, and help each other through tough times. These outings are our way of saying thank you to our team for all their hard work. It’s about creating memories beyond the office, building trust, and making everyone feel like they truly belong. I’m more sure than ever that a company’s success depends on how it treats its people. What do you think, let me know in the comment?Likes : 45725

45.7K Likes – Neha Nagar Instagram

Caption : Siya on her 4th team outing 🙂 Every employee deserves a company that treats them more than just employees—one that cares for them like a real family. Our team means everything to us. It’s not just about getting the work done; it’s about the bond we share that makes our journey special. Last week, we finished our fourth team outing in the last two years, this time to the beautiful hills of Manali. This trip brought us even closer and reminded us of why we value these moments together. When we arrived in Manali, everyone was amazed by the stunning mountains and the cool, crisp air. The peaceful vibe set the perfect tone for our trip. Our evenings were filled with fun as we played games like UNO and Damsharas, with everyone showing their playful side. It was great to see our team relaxing and enjoying each other’s company. The next day, we went on a hike to Jogini Waterfall. The hike was refreshing, and the waterfall was absolutely gorgeous. It was a moment to take in the beauty around us and think about how far we’ve come as a team. But beyond the fun, this trip was a reminder of what we stand for. we’re not just coworkers—we’re a family. We support each other, celebrate our wins, and help each other through tough times. These outings are our way of saying thank you to our team for all their hard work. It’s about creating memories beyond the office, building trust, and making everyone feel like they truly belong. I’m more sure than ever that a company’s success depends on how it treats its people. What do you think, let me know in the comment?Likes : 45725

45.7K Likes – Neha Nagar Instagram

Caption : Siya on her 4th team outing 🙂 Every employee deserves a company that treats them more than just employees—one that cares for them like a real family. Our team means everything to us. It’s not just about getting the work done; it’s about the bond we share that makes our journey special. Last week, we finished our fourth team outing in the last two years, this time to the beautiful hills of Manali. This trip brought us even closer and reminded us of why we value these moments together. When we arrived in Manali, everyone was amazed by the stunning mountains and the cool, crisp air. The peaceful vibe set the perfect tone for our trip. Our evenings were filled with fun as we played games like UNO and Damsharas, with everyone showing their playful side. It was great to see our team relaxing and enjoying each other’s company. The next day, we went on a hike to Jogini Waterfall. The hike was refreshing, and the waterfall was absolutely gorgeous. It was a moment to take in the beauty around us and think about how far we’ve come as a team. But beyond the fun, this trip was a reminder of what we stand for. we’re not just coworkers—we’re a family. We support each other, celebrate our wins, and help each other through tough times. These outings are our way of saying thank you to our team for all their hard work. It’s about creating memories beyond the office, building trust, and making everyone feel like they truly belong. I’m more sure than ever that a company’s success depends on how it treats its people. What do you think, let me know in the comment?Likes : 45725

45.7K Likes – Neha Nagar Instagram

Caption : Siya on her 4th team outing 🙂 Every employee deserves a company that treats them more than just employees—one that cares for them like a real family. Our team means everything to us. It’s not just about getting the work done; it’s about the bond we share that makes our journey special. Last week, we finished our fourth team outing in the last two years, this time to the beautiful hills of Manali. This trip brought us even closer and reminded us of why we value these moments together. When we arrived in Manali, everyone was amazed by the stunning mountains and the cool, crisp air. The peaceful vibe set the perfect tone for our trip. Our evenings were filled with fun as we played games like UNO and Damsharas, with everyone showing their playful side. It was great to see our team relaxing and enjoying each other’s company. The next day, we went on a hike to Jogini Waterfall. The hike was refreshing, and the waterfall was absolutely gorgeous. It was a moment to take in the beauty around us and think about how far we’ve come as a team. But beyond the fun, this trip was a reminder of what we stand for. we’re not just coworkers—we’re a family. We support each other, celebrate our wins, and help each other through tough times. These outings are our way of saying thank you to our team for all their hard work. It’s about creating memories beyond the office, building trust, and making everyone feel like they truly belong. I’m more sure than ever that a company’s success depends on how it treats its people. What do you think, let me know in the comment?Likes : 45725

45.7K Likes – Neha Nagar Instagram