Most liked photo of Shreyaa Kapoor with over 17.7K likes is the following photo

We have around 101 most liked photos of Shreyaa Kapoor with the thumbnails listed below. Click on any of them to view the full image along with its caption, like count, and a button to download the photo.

![Shreyaa Kapoor - 17.7K Likes - Did you know you can avoid paying taxes on the sale of your residential property? 🌱

One of the most popular ways to save tax on the sale of residential property is to reinvest the capital gains in another residential property. 🌟

To qualify for this exemption under Section 54 of the Income Tax Act, 1961, you will need to purchase a new property either one year before or two years after the sale. 🙌🏼

Alternatively, if you construct a new property within three years after the sale you can still apply for the exemption.🙏🏼

This is one of many ways you can LEGALLY avoid paying any taxes on capital gains - will share other ways too, soon! 🎉

Till then make sure you share this with your friends to help them avoid taxes this season and follow along, if you haven’t already! 🫡

.

.

[property, real estate, Shreyaa Kapoor, taxation, tax, tax tips, capital gains tax, house, property tax]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-4-dtbiqE6987.jpg)

17.7K Likes – Shreyaa Kapoor Instagram

Caption : Did you know you can avoid paying taxes on the sale of your residential property? 🌱 One of the most popular ways to save tax on the sale of residential property is to reinvest the capital gains in another residential property. 🌟 To qualify for this exemption under Section 54 of the Income Tax Act, 1961, you will need to purchase a new property either one year before or two years after the sale. 🙌🏼 Alternatively, if you construct a new property within three years after the sale you can still apply for the exemption.🙏🏼 This is one of many ways you can LEGALLY avoid paying any taxes on capital gains – will share other ways too, soon! 🎉 Till then make sure you share this with your friends to help them avoid taxes this season and follow along, if you haven’t already! 🫡 . . [property, real estate, Shreyaa Kapoor, taxation, tax, tax tips, capital gains tax, house, property tax]Likes : 17748

![Shreyaa Kapoor - 10.8K Likes - My dad, is the OG freelancer - he started his own consuting company 25 years ago! 🙌🏼

Since then he has not only worked with some of India’s leading companies but also generated employment for over 60 people! 🧿

However, the business has been very traditional from the get go - he mostly gets clients from word of mouth or just in person networking and hence, after pestering him for years; we finally got to making a website for his export import consultancy business.🌟

All thanks to @odoo.official which is an end to end business management tool - this all in one platform allows you to do customer relations, brand building, accounting, sales and much more!🎉 #partnership

It is so easy to use - my dad with no coding experience built a website in under 10 mins - publishing it soon! 🫶🏼

You can check it out for your small business or side hustle using the link in my bio!❤️

.

.

[small business, side hustle, freelancing, startup India, Odoo, website, business, freelancers, small biz, Shreyaa Kapoor, freelancing tips, side hustle tools]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-3-lbA5CM7784.jpg)

10.8K Likes – Shreyaa Kapoor Instagram

Caption : My dad, is the OG freelancer – he started his own consuting company 25 years ago! 🙌🏼 Since then he has not only worked with some of India’s leading companies but also generated employment for over 60 people! 🧿 However, the business has been very traditional from the get go – he mostly gets clients from word of mouth or just in person networking and hence, after pestering him for years; we finally got to making a website for his export import consultancy business.🌟 All thanks to @odoo.official which is an end to end business management tool – this all in one platform allows you to do customer relations, brand building, accounting, sales and much more!🎉 #partnership It is so easy to use – my dad with no coding experience built a website in under 10 mins – publishing it soon! 🫶🏼 You can check it out for your small business or side hustle using the link in my bio!❤️ . . [small business, side hustle, freelancing, startup India, Odoo, website, business, freelancers, small biz, Shreyaa Kapoor, freelancing tips, side hustle tools]Likes : 10811

6.5K Likes – Shreyaa Kapoor Instagram

Caption : If you are looking to get that latest phone, laptop, headphones or anything else under the sun – hold your horses! 🫡 Tata Neu The Grand sale is now underway, and it’s featuring some fantastic discounts across various categories!🥳 A whopping up to 70% off on Electronics!😌 What’s more, you can earn 5% Neu Coins with every purchase, which you can redeem later for your future shopping needs!🙌🏼 Make sure to follow @tataneuofficial to know more!💻 . . #collab #TataNeu #TataNeuTheGrandSale #Shopping #TheGrandSale #Rewards #NeuCoinsLikes : 6521

4.5K Likes – Shreyaa Kapoor Instagram

Caption : More here👇 👵 Eligibility: – Available to individuals aged 60 and above. – Individuals aged 55-60 who have retired under a voluntary retirement scheme (VRS) or superannuation can also open an account within one month of receiving their retirement benefits. 💵 Investment Limit: – Deposit a minimum of Rs. 1,000 and a maximum of Rs. 30 lakh. 📅 Tenure: – Fixed maturity period of 5 years, extendable for an additional 3 years. 💸 Interest Rate: – The interest rate on SCSS is typically higher than that of regular savings accounts. – The rate is set by the government and is subject to periodic revisions. 💼 Account Type: – Open an SCSS account at designated post offices and authorized banks. 🏦 Tax Benefits: – Eligible for a deduction under Section 80C, with limits. – Taxable interest income, but subject to deductions. 📆 Interest Payout: – Quarterly interest payouts for regular income. 💡 Premature Withdrawal: – Allowed after 1 year, but with a penalty. 💼 Account Transfer – Transfer your SCSS account between authorized banks or post offices. 📊 Investment after Maturity: – Extend for 3 more years at a potentially higher interest rate. #personalfinance #financialliteracy #interestrates #financialeducation #postofficeLikes : 4522

![Shreyaa Kapoor - 4K Likes - Think about the women in your life; I am certain they not only provide emotional assistance but also financial! ✨

With the changing times women are contributing equally to their household and in some cases are also primary bread earners. 💰

In such a scenario, it becomes essential that they are insured with term insurance and here is why:

- It provides financial security to a woman’s dependents in case of her untimely demise.

- It ensures that her loved ones are financially supported and can cover expenses like mortgages, children’s education, or daily living costs.

- Income Replacement: Term insurance helps replace this lost income, ensuring that the family can maintain their standard of living even after the woman’s passing.

- Coverage for Debt: If a woman has any outstanding debts like loans or mortgages, a term insurance policy can cover these, preventing her family from being burdened with these financial obligations.

- Cost-Effective Coverage: Term insurance usually offers a high coverage amount at relatively affordable premiums, making it an efficient way for women to secure their family’s financial future.

- Tax deduction: Moreover we can also claim a tax deduction of up to Rs. 1.5L under 80C

If you are looking to get term insurance for yourself or women in your life, head to @policybazaar or tap the link in my bio where you can compare multiple policies and choose the one that fits your specific requirements!

#collab

.

.

[insurance, term insurance, insurance for women, women insurance]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-6-e2psTN3644.jpg)

4K Likes – Shreyaa Kapoor Instagram

Caption : Think about the women in your life; I am certain they not only provide emotional assistance but also financial! ✨ With the changing times women are contributing equally to their household and in some cases are also primary bread earners. 💰 In such a scenario, it becomes essential that they are insured with term insurance and here is why: – It provides financial security to a woman’s dependents in case of her untimely demise. – It ensures that her loved ones are financially supported and can cover expenses like mortgages, children’s education, or daily living costs. – Income Replacement: Term insurance helps replace this lost income, ensuring that the family can maintain their standard of living even after the woman’s passing. – Coverage for Debt: If a woman has any outstanding debts like loans or mortgages, a term insurance policy can cover these, preventing her family from being burdened with these financial obligations. – Cost-Effective Coverage: Term insurance usually offers a high coverage amount at relatively affordable premiums, making it an efficient way for women to secure their family’s financial future. – Tax deduction: Moreover we can also claim a tax deduction of up to Rs. 1.5L under 80C If you are looking to get term insurance for yourself or women in your life, head to @policybazaar or tap the link in my bio where you can compare multiple policies and choose the one that fits your specific requirements! #collab . . [insurance, term insurance, insurance for women, women insurance]Likes : 4043

1.1K Likes – Shreyaa Kapoor Instagram

Caption : Are those long toll queues ruining your travel plans? 🫠 Not anymore! 🫶🏼 @airtelpaymentsbank has the ultimate solution – NETC FASTag! 🌱 Say goodbye to wasted time and hello to seamless travel. Buy NETC FASTag with #AirtelPaymentsBank, and get it delivered home for free and instantly activated. 🙏🏼 You can recharge it anytime, anywhere, and you will even get an SMS for every transaction. 🙌🏼 Download the Airtel Thanks App now to make instant daily payments! ✅ #FASTag #HassleFreeTravel #ad . . #finance #payments #dailytransactions #airtelpaymentsbank #securityLikes : 1111

![Shreyaa Kapoor - 3 Likes - If you want to reduce your home loan tenure, apart from the strategy discussed in the reel here is what you can keep in mind:

1. Choose Your Loan Length Wisely 🤔

- Short loans mean higher monthly payments but less total interest.

- Long loans have smaller payments but cost more in interest overall.

- Find a middle ground that fits your budget.

- Example: For a ₹50 lakh loan at 8.75%:

- 10 years: Pay ₹22.76 lakh in interest

- 20 years: Pay ₹50.29 lakh in interest

2. Make Extra Payments When Possible ✨

- Early loan payments mostly go toward interest.

- Extra payments in the first few years save money.

- Use bonuses or extra income to make additional payments.

- Many floating-rate loans don’t charge fees for extra payments.

3. Try to Get Lower Interest Rates🙌🏼

- Good credit and payment history can help you qualify for better rates.

- Ask your lender about reducing your rate.

- Consider increasing your monthly payment as your income grows.

- This helps pay off the loan faster.

4. Consider Switching Lenders🫢

- If your current lender won’t lower rates, look elsewhere.

- Moving your loan to a new lender is called balance transfer.

- Many lenders offer special deals for transfers.

Share this with your friends and family and follow along for more!🌟

.

.

[personal finance tips, finance tips, money tips, home loan, home loan hacks, loan tips, loan transfer]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-26-qQjgA73027.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : If you want to reduce your home loan tenure, apart from the strategy discussed in the reel here is what you can keep in mind: 1. Choose Your Loan Length Wisely 🤔 – Short loans mean higher monthly payments but less total interest. – Long loans have smaller payments but cost more in interest overall. – Find a middle ground that fits your budget. – Example: For a ₹50 lakh loan at 8.75%: – 10 years: Pay ₹22.76 lakh in interest – 20 years: Pay ₹50.29 lakh in interest 2. Make Extra Payments When Possible ✨ – Early loan payments mostly go toward interest. – Extra payments in the first few years save money. – Use bonuses or extra income to make additional payments. – Many floating-rate loans don’t charge fees for extra payments. 3. Try to Get Lower Interest Rates🙌🏼 – Good credit and payment history can help you qualify for better rates. – Ask your lender about reducing your rate. – Consider increasing your monthly payment as your income grows. – This helps pay off the loan faster. 4. Consider Switching Lenders🫢 – If your current lender won’t lower rates, look elsewhere. – Moving your loan to a new lender is called balance transfer. – Many lenders offer special deals for transfers. Share this with your friends and family and follow along for more!🌟 . . [personal finance tips, finance tips, money tips, home loan, home loan hacks, loan tips, loan transfer]Likes : 3

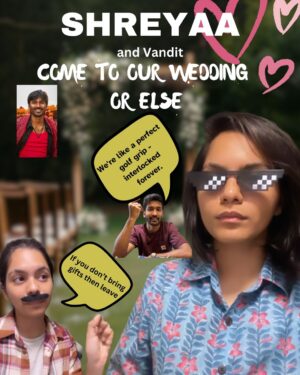

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Jan 2024 it was decided that my wedding would be in Dec. And now that we are here, I feel I was a lot more mindful and grateful for people around me this year. 🫶🏼 Maybe it was the fact that I knew that it is indeed so transient because I am moving outside India post marriage. 🫢 Here is a little peak into the months that went by! ❤️ Jan: Got this picture sent from a childhood friend who is a bridesmaid at my wedding. Crazy how fast we grew up. Feb: Attended coldplay in BKK but the highlight was the fact that this trip was with my 2 best friends from Bain! Mar: Spring had sprung. And I couldn’t be more happy! 🌱 Apr: Gave a TEDx talk! May: Bdayy month and I couldn’t care less but people around me cared wayyy too much! 🧿 Jun: Shot 5 videos back to back in peak Delhi heat! Jul: This was roka month! Explored literally all wedding markets in Delhi! 🫠 Aug: They say you are best friends with people you have least pictures with. And this twirl is the only decent picture I have with my best friend of 17 years who is also getting married soon! 😭 Sept: Finally decided to do wedding shopping. Sabyasachi was amazing but it just didn’t make sense to me as a finance creator. 😵 Oct: Did a small weekend trip with all my Bain friends. Boon at Bain. 🤝 Nov: Vandit and I went into long distance relationship yet again. (Have been for 4 years out of 8 total). He sent these flowers coz I was going crazy with wedding prep. I think I took like 1000 photos. Also went to Dubai?! Dec: Official wedding invite we sent out. NO INCOME TAX FTW! 🙌🏼 The wedding is just around the corner and I’m so grateful for the people who kept me sane throughout! And that includes you! Thank you so much for sticking around this year! ❤️ Only asking for your love and wishes as I step into the next chapter of my life! 🙏🏼Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Did you know you can turn your everyday purchases into your next getaway! ✨ The MakeMyTrip ICICI Bank Credit Card lets you earn travel rewards with every swipe, and unlike those forgotten New Year’s resolutions, these points stick around! 🌟 No expiry dates, no pressure – just stack your rewards and book your dream trip whenever you’re ready.🫶🏼 T&C* apply . . #MakeMyTripICICIBank #makemytrip #icicibank #paidpartnershipLikes : 3

![Shreyaa Kapoor - 3 Likes - What if I told you - there is a ticket to invest in the real estate big leagues without needing millions in the bank.

It’s called - REITS! 🌟

Think of them as companies that own and manage properties - from shopping malls to data centers - and share the rental income with investors like you and I! 🤝

These companies are required to share 90% of their profits with shareholders, making them an interesting option for income-focused investors. 🌱

You can buy them just like regular stocks through major exchanges, no real estate agent required!🙌🏼

Would you consider investing in one? Let me know in the comments! 🙏🏼

.

.

[REIT, real estate, real estate investing, investing tips, investment, personal finance, finance hacks, property investment]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-45-zFLqch2215.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : What if I told you – there is a ticket to invest in the real estate big leagues without needing millions in the bank. It’s called – REITS! 🌟 Think of them as companies that own and manage properties – from shopping malls to data centers – and share the rental income with investors like you and I! 🤝 These companies are required to share 90% of their profits with shareholders, making them an interesting option for income-focused investors. 🌱 You can buy them just like regular stocks through major exchanges, no real estate agent required!🙌🏼 Would you consider investing in one? Let me know in the comments! 🙏🏼 . . [REIT, real estate, real estate investing, investing tips, investment, personal finance, finance hacks, property investment]Likes : 3

![Shreyaa Kapoor - 3 Likes - Which asset class gives you the maximum tax benefits?

Well - Real estate! ✨

No matter what step in the process you are at - there are some or the other tax benefits you can avail!🙏🏼

-During Home Purchase and Ownership

Section 80C : Claim up to ₹1.5 lakhs annually on home loan principal repayment

Section 24(b) :Deduct up to ₹2 lakhs annually on home loan interest for self-occupied property

Then if you are renting claim: House Rent Allowance (HRA) Benefits

- If you own a house in a different city and live on rent in current city:

- Claim both HRA deduction on rent paid

- Avail tax benefits on home loan for owned property

Then if you sell that house?🤝

Section 54 - Reinvestment Benefits

- Available when selling a residential property after 24 months

- Capital gains tax exemption if reinvested in:

- One residential house within India (within 2 years of sale)

- Construction of a house (within 3 years of sale)

Section 54EC - Alternative Investment

- Invest capital gains in specified bonds within 6 months of property sale

- Maximum investment cap of ₹50 lakhs

- Bonds must be held for 5 years

Share this with your friends and save this for your reference!🫶🏼

.

.

[home loan, loan tips, house, personal finance, tax tips, taxation]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-46-NhTkrx187.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : Which asset class gives you the maximum tax benefits? Well – Real estate! ✨ No matter what step in the process you are at – there are some or the other tax benefits you can avail!🙏🏼 -During Home Purchase and Ownership Section 80C : Claim up to ₹1.5 lakhs annually on home loan principal repayment Section 24(b) :Deduct up to ₹2 lakhs annually on home loan interest for self-occupied property Then if you are renting claim: House Rent Allowance (HRA) Benefits – If you own a house in a different city and live on rent in current city: – Claim both HRA deduction on rent paid – Avail tax benefits on home loan for owned property Then if you sell that house?🤝 Section 54 – Reinvestment Benefits – Available when selling a residential property after 24 months – Capital gains tax exemption if reinvested in: – One residential house within India (within 2 years of sale) – Construction of a house (within 3 years of sale) Section 54EC – Alternative Investment – Invest capital gains in specified bonds within 6 months of property sale – Maximum investment cap of ₹50 lakhs – Bonds must be held for 5 years Share this with your friends and save this for your reference!🫶🏼 . . [home loan, loan tips, house, personal finance, tax tips, taxation]Likes : 3

![Shreyaa Kapoor - 3 Likes - If you are planning an investment into real estate in India, here are some facts you should consider, that might change your mind!🤔

• According to Better Homes Residential Market Report - Indian buyers are now Dubai’s #1 property investors, beating out British buyers. 🙌🏼

• Dubai’s 1% rule makes buying easier - investors can pay just 1% of the property price monthly, instead of large upfront payments! 🤯

• Zero tax on property gains means investors keep all their profits, unlike in India where they pay capital gains tax. 🫠

• Dubai gives investors long-term visas and allows 100% foreign ownership in many areas, making it easier to manage properties. ✨

• Properties in Dubai give higher rental returns compared to most global cities, making them good income sources! 🙏🏼

All in all, Dubai is lucrative location for buying real estate, offering a better ROI than most metro cities in India. 🌱

Would you invest in real estate outside of India?🫢

.

.

[real estate, property, house ownership, home buying, real estate investment, personal finance, personal finance tips, investment, Dubai, UAE]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-47-9N8GoQ264.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : If you are planning an investment into real estate in India, here are some facts you should consider, that might change your mind!🤔 • According to Better Homes Residential Market Report – Indian buyers are now Dubai’s #1 property investors, beating out British buyers. 🙌🏼 • Dubai’s 1% rule makes buying easier – investors can pay just 1% of the property price monthly, instead of large upfront payments! 🤯 • Zero tax on property gains means investors keep all their profits, unlike in India where they pay capital gains tax. 🫠 • Dubai gives investors long-term visas and allows 100% foreign ownership in many areas, making it easier to manage properties. ✨ • Properties in Dubai give higher rental returns compared to most global cities, making them good income sources! 🙏🏼 All in all, Dubai is lucrative location for buying real estate, offering a better ROI than most metro cities in India. 🌱 Would you invest in real estate outside of India?🫢 . . [real estate, property, house ownership, home buying, real estate investment, personal finance, personal finance tips, investment, Dubai, UAE]Likes : 3

![Shreyaa Kapoor - 3 Likes - Here are the next books 10 I would recommend!🙏🏼

6) The Almanack of Naval Ravikant by Eric Jorgenson

Ofc this is a no brainer! A comprehensive collection of wisdom from Naval Ravikant on wealth, happiness, and life philosophy. ✨

7) Atomic Habits by James Clear

This book presents a practical framework for understanding how tiny changes can yield remarkable results. 🌟

8) High Output Management by Andy Grove

Written by former Intel CEO, this book is the ultimate guide to management and leadership. Invaluable for anyone in a leadership position.⚡️

9) Zero to One by Peter Thiel

Thiel challenges conventional wisdom about entrepreneurship and innovation. Must read for anyone starting their own business!🌱

10) Deep Work by Cal Newport

In our increasingly distracted world, Newport makes a compelling case for the power of focused, uninterrupted work.✉️

Continued in pinned comments! ❤️

.

.

[personal finance, books, book recommendations, non fiction, money books, business books]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-48-lkSJbx9869.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : Here are the next books 10 I would recommend!🙏🏼 6) The Almanack of Naval Ravikant by Eric Jorgenson Ofc this is a no brainer! A comprehensive collection of wisdom from Naval Ravikant on wealth, happiness, and life philosophy. ✨ 7) Atomic Habits by James Clear This book presents a practical framework for understanding how tiny changes can yield remarkable results. 🌟 8) High Output Management by Andy Grove Written by former Intel CEO, this book is the ultimate guide to management and leadership. Invaluable for anyone in a leadership position.⚡️ 9) Zero to One by Peter Thiel Thiel challenges conventional wisdom about entrepreneurship and innovation. Must read for anyone starting their own business!🌱 10) Deep Work by Cal Newport In our increasingly distracted world, Newport makes a compelling case for the power of focused, uninterrupted work.✉️ Continued in pinned comments! ❤️ . . [personal finance, books, book recommendations, non fiction, money books, business books]Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Rare whispers of earth, crystallized over billions of years. Uncut magic pressed by nature’s silent intensity, these carbon treasures emerge as timeless, brilliant gems embodying pure, pristine perfection—each stone a unique testament to geological wonder. ✨ Celebrate life’s milestones with a gift as unique and enduring as you and your journey!🧿 . . #timelessdiamonds #jewellery #diamonds #tanishqdiamondsLikes : 3

![Shreyaa Kapoor - 3 Likes - Why is no one talking about the WEDDING TAX! 😵

Just because it is not official doesn’t mean it is not real! 🫠

No matter the service - from makeup to decor to food, everything becomes 2x-3x the normal price the minute you tell the vendor it’s for a wedding! ⚡️

This frustration comes from the countless negotiations I have had to do over the months leading up to my own wedding!😭

TELL ME WHY MAKEUP IS 51,000 RUPEES!😅

OR SIMPLY GETTING PICTURES CLICKED IS 3L!😕

OR GETTING MEHENDI IS 11,000 MINIMUM!😩

Either I am getting prices in Zimbabwean dollars or the wedding market is over inflated for real!🤯

I have shared some tips to combat it too - hope this helps!🤔

Do share with all brides and grooms to be - or else they are cooked for real. (Obv priced per plate)🫢

.

.

[wedding season, wedding, personal finance, finance tips, wedding tips, money tips, wedding expenses, bridal makeup, MUA]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-1-boLedE9117.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : Why is no one talking about the WEDDING TAX! 😵 Just because it is not official doesn’t mean it is not real! 🫠 No matter the service – from makeup to decor to food, everything becomes 2x-3x the normal price the minute you tell the vendor it’s for a wedding! ⚡️ This frustration comes from the countless negotiations I have had to do over the months leading up to my own wedding!😭 TELL ME WHY MAKEUP IS 51,000 RUPEES!😅 OR SIMPLY GETTING PICTURES CLICKED IS 3L!😕 OR GETTING MEHENDI IS 11,000 MINIMUM!😩 Either I am getting prices in Zimbabwean dollars or the wedding market is over inflated for real!🤯 I have shared some tips to combat it too – hope this helps!🤔 Do share with all brides and grooms to be – or else they are cooked for real. (Obv priced per plate)🫢 . . [wedding season, wedding, personal finance, finance tips, wedding tips, money tips, wedding expenses, bridal makeup, MUA]Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : IG LIVELikes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Aunties and Uncles, Boys and Girls – Stop paying hidden charges on your banking needs. 😵 Just open a Savings Account with IDFC FIRST Bank and enjoy Zero Fee Banking on all Savings Account services.🙌🏼 Watch your Savings thrive and get #MoreFromYourBank✨ *T&C Apply. . . #IDFCFIRSTBank #MoreFromYourBank #partnershipLikes : 3

![Shreyaa Kapoor - 3 Likes - Dhanteras is just around the corner! 🫶🏼

This means it’s time to buy gold to honour our traditions but instead of purchasing gold coins that often stay locked away in safes, consider investing in wearable 18K gold jewellery that serves both ritual and practical purposes.🪔

Elegantly designed rings, delicate necklaces, or versatile earrings in 18K gold offer everyday wearability while maintaining the tradition’s essence. ⭐️

18K gold (75% pure gold) provides an ideal balance between durability and luxury. 🌟

Its lower pure gold content actually makes it better suited for intricate designs and daily wear compared to 22K or 24K gold. ✨

Head to Mia for the best designs for your everyday use!🌸

.

.

[gold, Dhanteras, jewellery, personal finance, gold jewellery]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-4-asGEmz4657.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : Dhanteras is just around the corner! 🫶🏼 This means it’s time to buy gold to honour our traditions but instead of purchasing gold coins that often stay locked away in safes, consider investing in wearable 18K gold jewellery that serves both ritual and practical purposes.🪔 Elegantly designed rings, delicate necklaces, or versatile earrings in 18K gold offer everyday wearability while maintaining the tradition’s essence. ⭐️ 18K gold (75% pure gold) provides an ideal balance between durability and luxury. 🌟 Its lower pure gold content actually makes it better suited for intricate designs and daily wear compared to 22K or 24K gold. ✨ Head to Mia for the best designs for your everyday use!🌸 . . [gold, Dhanteras, jewellery, personal finance, gold jewellery]Likes : 3

![Shreyaa Kapoor - 3 Likes - Want to save money on your home loan? 🛋️

Here is how you do it! 🌟

- Claim 1.5 lakhs as deduction in principal amount repayment 🌱

- Claim 2 lakhs as deduction for interest amount paid ( can even claim processing fees) ✨

- Take a joint home loan to double the tax benefits as both partners can now claim these deductions! 🫡

You can save ~2 lakhs in taxes if you are in the 30% tax bracket! 🫂

Apart from just the tax benefits - women have other advantages when it comes to a home loan such as lower stamp duty and interest rates!🙌🏼

Share this with your friends getting married soon and help them save taxes! 🌸

.

.

[tax tips, taxes, taxation, home owner, home loan, loan tips, marriage, wedding hacks, personal finance, finance tips]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-5-ecsLJd2983.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : Want to save money on your home loan? 🛋️ Here is how you do it! 🌟 – Claim 1.5 lakhs as deduction in principal amount repayment 🌱 – Claim 2 lakhs as deduction for interest amount paid ( can even claim processing fees) ✨ – Take a joint home loan to double the tax benefits as both partners can now claim these deductions! 🫡 You can save ~2 lakhs in taxes if you are in the 30% tax bracket! 🫂 Apart from just the tax benefits – women have other advantages when it comes to a home loan such as lower stamp duty and interest rates!🙌🏼 Share this with your friends getting married soon and help them save taxes! 🌸 . . [tax tips, taxes, taxation, home owner, home loan, loan tips, marriage, wedding hacks, personal finance, finance tips]Likes : 3

![Shreyaa Kapoor - 3 Likes - First and foremost, this video is not sponsored! ✨

That being said - I recently went to India’s top rated restaurant, and the tasting menu is an experience you should try out at least once! 🌱

I was able to get the same experience for a steal all thanks to my credit card!🌟

Unfortunately, they have ended that scheme, but that doesn’t mean there aren’t still MANY offers you can make use of if you hold Amex cards. 🙏🏼

Which credit card do you want a deep dive on next? Let me know in the comments below!✨

.

.

[Amex, American Express, credit cards, Indian accent, restaurant, personal finance, finance, credit card tips]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-6-hOBtHh1526.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : First and foremost, this video is not sponsored! ✨ That being said – I recently went to India’s top rated restaurant, and the tasting menu is an experience you should try out at least once! 🌱 I was able to get the same experience for a steal all thanks to my credit card!🌟 Unfortunately, they have ended that scheme, but that doesn’t mean there aren’t still MANY offers you can make use of if you hold Amex cards. 🙏🏼 Which credit card do you want a deep dive on next? Let me know in the comments below!✨ . . [Amex, American Express, credit cards, Indian accent, restaurant, personal finance, finance, credit card tips]Likes : 3

![Shreyaa Kapoor - 3 Likes - Forget everything you know about fixed deposits. 🫠

They aren’t now only there for you getting returns that hardly beat inflation - with Airtel Finance, start an FD that gives up to 9.5% returns! 🙏🏼

High returns without the high risks of market volatility. Your investment is in RBI backed banks and AAA crisil rated NBFCs. Bank FDs upto 5 lakh is insured by DICGC.✨

So whether you’re saving for a goal or looking to grow your wealth steadily, Fixed Deposit by Airtel Finance offers the perfect blend of safety and rewarding returns. 🧿

Start your journey to financial growth today!🌟

.

.

#FDMeinInterestBadhega #AirtelFinance #FixedDepositsByAirtelFinance #collab

[Fixed Deposit, Investment, Wedding, Marriage, Airtel finance, Banks]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-7-1mvPnN2711.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : Forget everything you know about fixed deposits. 🫠 They aren’t now only there for you getting returns that hardly beat inflation – with Airtel Finance, start an FD that gives up to 9.5% returns! 🙏🏼 High returns without the high risks of market volatility. Your investment is in RBI backed banks and AAA crisil rated NBFCs. Bank FDs upto 5 lakh is insured by DICGC.✨ So whether you’re saving for a goal or looking to grow your wealth steadily, Fixed Deposit by Airtel Finance offers the perfect blend of safety and rewarding returns. 🧿 Start your journey to financial growth today!🌟 . . #FDMeinInterestBadhega #AirtelFinance #FixedDepositsByAirtelFinance #collab [Fixed Deposit, Investment, Wedding, Marriage, Airtel finance, Banks]Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Planning a proposal or just generally looking to get diamonds? 💍 You can save big on diamonds with a simple trick: opt for a 0.9 carat stone instead of 1 carat. 💎 These slightly smaller diamonds look virtually identical to the naked eye but come with a significantly lower price tag.🏷️ The 1 carat mark is in high demand, driving up costs disproportionately. By choosing just below this threshold, you get a visually equivalent diamond while keeping more cash in your pocket. 🌟 Smart shoppers know that this minor size difference offers major savings without sacrificing sparkle or impact.✨ Share this with someone getting married soon!💐 . . #personalfinance #financetips #diamonds #weddingplanning #moneysaver #moneyhacksLikes : 3

![Shreyaa Kapoor - 3 Likes - Markets are extremely volatile but how to know if a stock is overvalued or worth buying? 😅

Well the concept is called intrinsic value - where you find the actual value of the share rather than getting swept away by the market price, as discussed in the reel! 🪴

But then how do you find the intrinsic value of a share?

One of the simplist way to do so is checking the P/E ratio or the price to earnings ratio!🙌🏼

It is the ratio of a company’s share price to the company’s earnings per share. 💯

You can compare it to the industry average and its peers to see how the company you are eyeing is performing. 🌱

Please note that this metric also is often not sufficient as you also need to see variables such as future growth prospects etc. 📈

So look at PE only as a directional answer!🌟

Dropping other ways to figure out intrinsic value soon!👩🏻💻

Please note - this is not a buy sell recommendation for any stock. The companies are taken as examples for educational purposes only!🙏🏼

.

.

[investing tips, investing basics, stock market, Bajaj housing, PE ratio, share market, personal finance]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-9-M3Meow296.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : Markets are extremely volatile but how to know if a stock is overvalued or worth buying? 😅 Well the concept is called intrinsic value – where you find the actual value of the share rather than getting swept away by the market price, as discussed in the reel! 🪴 But then how do you find the intrinsic value of a share? One of the simplist way to do so is checking the P/E ratio or the price to earnings ratio!🙌🏼 It is the ratio of a company’s share price to the company’s earnings per share. 💯 You can compare it to the industry average and its peers to see how the company you are eyeing is performing. 🌱 Please note that this metric also is often not sufficient as you also need to see variables such as future growth prospects etc. 📈 So look at PE only as a directional answer!🌟 Dropping other ways to figure out intrinsic value soon!👩🏻💻 Please note – this is not a buy sell recommendation for any stock. The companies are taken as examples for educational purposes only!🙏🏼 . . [investing tips, investing basics, stock market, Bajaj housing, PE ratio, share market, personal finance]Likes : 3

3 Likes – Shreyaa Kapoor Instagram

Caption : Why go for the all new TVS Jupiter? 🛵 Well because who doesn’t want amazing features at an affordable price? 🫡 . . #AllNewTVSJupiter #ScooterThatsMore #TVS #ZyadaKaFayda #collabLikes : 3

![Shreyaa Kapoor - 3 Likes - Starting a business? Stand Up India scheme has your back with collateral-free loans up to 1 crore for women entrepreneurs. 🙌🏼

One of the key features of the Stand Up India scheme is its collateral security. 🙏🏼

For projects up to ₹10 lakhs, no collateral is required. For projects above ₹10 lakhs, the loan is secured against the assets created from the loan proceeds. 🌱

Interest rates are set according to bank guidelines and are typically lower than standard rates. Women entrepreneurs, in particular, benefit from an interest subvention of 3% per annum.👩🏻💻

And that website? Built FOR FREE with Odoo - first app free forever, plus free hosting, support, and domain for a year! 🙏🏼

Share this with all your fellow female business starters! 🌱

.

.

[business, website, entrepreneurship, personal finance, government scheme, loan, business loan]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-11-bSFAFQ4271.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : Starting a business? Stand Up India scheme has your back with collateral-free loans up to 1 crore for women entrepreneurs. 🙌🏼 One of the key features of the Stand Up India scheme is its collateral security. 🙏🏼 For projects up to ₹10 lakhs, no collateral is required. For projects above ₹10 lakhs, the loan is secured against the assets created from the loan proceeds. 🌱 Interest rates are set according to bank guidelines and are typically lower than standard rates. Women entrepreneurs, in particular, benefit from an interest subvention of 3% per annum.👩🏻💻 And that website? Built FOR FREE with Odoo – first app free forever, plus free hosting, support, and domain for a year! 🙏🏼 Share this with all your fellow female business starters! 🌱 . . [business, website, entrepreneurship, personal finance, government scheme, loan, business loan]Likes : 3

![Shreyaa Kapoor - 3 Likes - Attending a free event helped me generate over 5 lakhs in revenue for my consulting business! 🪴

That’s the power of networking, and here is how you can do it right! 🌟

Sharing my top 5 learnings for you to implement next time you network!🙌🏼

# Networking Tip #1: Listen More Than You Speak 🫡

# Networking Tip #2: Provide Value First 💯

# Networking Tip #3: Be Open to learning - no matter who it is!🌱

# Networking Tip #4: Follow Up is Key 💻

It’s been a week, and I have closed deals worth over 5 lakhs, all from attending a free event! 💯

Remember, networking is all about building genuine relationships. So, get out there, attend events, and start connecting!🫂

.

.

[networking tips, networking, events, personal finance, branding, personal branding]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-0-RYNnbI7644.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : Attending a free event helped me generate over 5 lakhs in revenue for my consulting business! 🪴 That’s the power of networking, and here is how you can do it right! 🌟 Sharing my top 5 learnings for you to implement next time you network!🙌🏼 # Networking Tip #1: Listen More Than You Speak 🫡 # Networking Tip #2: Provide Value First 💯 # Networking Tip #3: Be Open to learning – no matter who it is!🌱 # Networking Tip #4: Follow Up is Key 💻 It’s been a week, and I have closed deals worth over 5 lakhs, all from attending a free event! 💯 Remember, networking is all about building genuine relationships. So, get out there, attend events, and start connecting!🫂 . . [networking tips, networking, events, personal finance, branding, personal branding]Likes : 3

![Shreyaa Kapoor - 3 Likes - If you are getting married soon - know that GST will come in play again and again! 😅

So understanding how GST works is the first step to saving money! 🙌🏼

-Service Classification: Determine if the service can be classified as a composite or a mixed supply. Composite supplies (where services are naturally bundled and supplied with each other like venue with catering) attract a single GST rate, usually the rate of the principal supply.🫡

-Venue Selection: Choosing a venue with a comprehensive package that includes catering, and possibly décor and photography, can reduce the GST rate to 5%, compared to hiring these services separately at potentially higher rates.🌟

As explained in the video - some services are better when bundles together say venue and catering while you are better off removing certain services from the bundle - say decor and photography!💯

Be mindful of the GST charges on the same to save money around your wedding!🌟

Share this with your friends getting married soon!💍

.

.

[marriage, wedding tips, tax hacks, taxation, personal finance, finance hacks, wedding, tax tips]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-1-JOL2NF1629.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : If you are getting married soon – know that GST will come in play again and again! 😅 So understanding how GST works is the first step to saving money! 🙌🏼 -Service Classification: Determine if the service can be classified as a composite or a mixed supply. Composite supplies (where services are naturally bundled and supplied with each other like venue with catering) attract a single GST rate, usually the rate of the principal supply.🫡 -Venue Selection: Choosing a venue with a comprehensive package that includes catering, and possibly décor and photography, can reduce the GST rate to 5%, compared to hiring these services separately at potentially higher rates.🌟 As explained in the video – some services are better when bundles together say venue and catering while you are better off removing certain services from the bundle – say decor and photography!💯 Be mindful of the GST charges on the same to save money around your wedding!🌟 Share this with your friends getting married soon!💍 . . [marriage, wedding tips, tax hacks, taxation, personal finance, finance hacks, wedding, tax tips]Likes : 3

![Shreyaa Kapoor - 3 Likes - If you are an absolute beginner to investing, like I was roughly 10 years back - Index funds are your holy grail. 🌟

Least cost & passive way of investing in Stock Markets. These funds are based on an underlying index like NIFTY, SENSEX, etc. and simply mirror the returns of that index. Index Funds are the most advocated way to invest by legendary investors like Warren Buffett for retail investors. 💯

You do not necessarily need a Demat account for index funds, but I would highly recommend you have one; hence, I have mentioned it in the video! If not, you can invest in them like you would in any mutual fund. 🫡

Index funds are very similar to ETFs - ETFs are better for frequent trading because you can buy and sell shares throughout the trading day, while index funds only allow trading at the end of the day. 🫡

But either one of them is IDEAL for beginners!🙌🏼

Here are some of the index funds you can get started with in 2024 - purely based on their returns and expense ratio:

Bandhan Nifty 50 Index Fund

UTI Nifty 50 Index Fund

SBI Nifty Index Fund

ICICI Prudential Nifty 50 Index Fund

HDFC Index Fund Nifty 50 Plan

The key is to get started rather than overthink which index fund/ ETF to go for!🌟

Please note this is not a partnership with any broker or fund - so do your research and choose the option that you find the most appealing! 🪴

This is honestly how I got started and if you still haven’t started your investing journey yet - this is how I would recommend you do it!🫶🏼

.

.

[investing, index funds, ETF, investing basics, personal finance, investing for beginners, investing tips, finance]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-2-d699Pg6641.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : If you are an absolute beginner to investing, like I was roughly 10 years back – Index funds are your holy grail. 🌟 Least cost & passive way of investing in Stock Markets. These funds are based on an underlying index like NIFTY, SENSEX, etc. and simply mirror the returns of that index. Index Funds are the most advocated way to invest by legendary investors like Warren Buffett for retail investors. 💯 You do not necessarily need a Demat account for index funds, but I would highly recommend you have one; hence, I have mentioned it in the video! If not, you can invest in them like you would in any mutual fund. 🫡 Index funds are very similar to ETFs – ETFs are better for frequent trading because you can buy and sell shares throughout the trading day, while index funds only allow trading at the end of the day. 🫡 But either one of them is IDEAL for beginners!🙌🏼 Here are some of the index funds you can get started with in 2024 – purely based on their returns and expense ratio: Bandhan Nifty 50 Index Fund UTI Nifty 50 Index Fund SBI Nifty Index Fund ICICI Prudential Nifty 50 Index Fund HDFC Index Fund Nifty 50 Plan The key is to get started rather than overthink which index fund/ ETF to go for!🌟 Please note this is not a partnership with any broker or fund – so do your research and choose the option that you find the most appealing! 🪴 This is honestly how I got started and if you still haven’t started your investing journey yet – this is how I would recommend you do it!🫶🏼 . . [investing, index funds, ETF, investing basics, personal finance, investing for beginners, investing tips, finance]Likes : 3

![Shreyaa Kapoor - 3 Likes - Getting married anytime soon? Well even if you aren’t - this tax saving hack can help! 🫶🏼

Consider forming an HUF to save on taxes!💯

Hindu undivided family is taxed separately from its members. Buddhists, Jains, and Sikhs can also form an HUF. HUF has its own PAN and files tax returns independently of its members.🙌🏼

An HUF is taxed separately. Therefore, it can claim deductions or exemptions allowed under the tax laws separately. For example, if you and your spouse, along with your 2 children decide to create an HUF, all 4 of you as well as the HUF can claim a deduction under Section 80C.🫡

The family members who have formed a HUF can take advantage of their own income tax benefits as well as HUF income tax exemption of up to Rs. 2.5 lakhs.🪴

.

.

[HUF, wedding, wedding tips, tax tips, taxation, personal finance, finance tips]](https://www.gethucinema.com/wp-content/uploads/2025/01/Shreyaa-Kapoor-3-whIR6V3844.jpg)

3 Likes – Shreyaa Kapoor Instagram

Caption : Getting married anytime soon? Well even if you aren’t – this tax saving hack can help! 🫶🏼 Consider forming an HUF to save on taxes!💯 Hindu undivided family is taxed separately from its members. Buddhists, Jains, and Sikhs can also form an HUF. HUF has its own PAN and files tax returns independently of its members.🙌🏼 An HUF is taxed separately. Therefore, it can claim deductions or exemptions allowed under the tax laws separately. For example, if you and your spouse, along with your 2 children decide to create an HUF, all 4 of you as well as the HUF can claim a deduction under Section 80C.🫡 The family members who have formed a HUF can take advantage of their own income tax benefits as well as HUF income tax exemption of up to Rs. 2.5 lakhs.🪴 . . [HUF, wedding, wedding tips, tax tips, taxation, personal finance, finance tips]Likes : 3

3 Likes – Shreyaa Kapoor Instagram